AKG weekly charts - Issue #146

This newsletter is a weekly selection of 10 charts hand-picked across the internet and research reports which pertains to our investment strategy and bring an updated insight and perspective.

Summary of financial markets in last week here

Connect on various social media platforms here

Subscribe (free) to #AKGweekendreadings here [Newletter released every Friday]

Nov’24 review of our equity research strategy- Special Situation & Wealth Compounders. [Visit www.fintrekkcapital.com for subscription details]

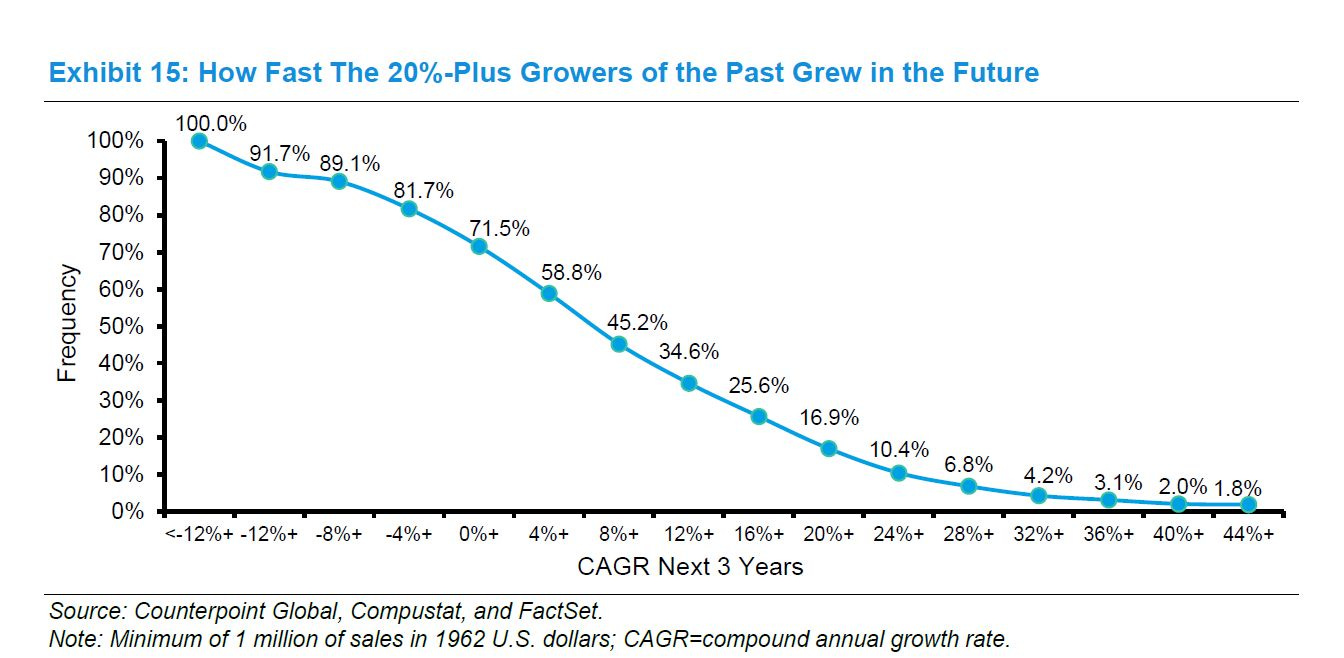

[1] How difficult to manage 20% plus sales growth in equity markets?

Only around 16% of companies which did sales growth of 20% in last 3 years followed with similar or higher sales growth in next 3 years vs more than 80% of companies reported significant decline in sales growth. In short, the probability of sales growth maintaining more than 20% beyond 3 years is very low.

[2] Trumphoria saw record inflows into US equity ETFs during November. The crowd is voting with its feet in terms of the market outlook.

[3] Bitcoin has been the top-performing asset in 8 of the last 10 years (including 2024). Naysayers still saying they don’t understand it. Can they now start putting in better efforts to understand it after this 10yr record?

[4] Dax has been a standout performer in Europe this year, climbing >20% for 2nd consecutive year. This strong market performance starkly contrasts the country's sluggish econ development, w/Germany lagging behind its European peers in growth and recovery.

[5] The gap between U.S. and China's borrowing costs has reached its widest level in more than 13 years. Trump takes charge on 20th Jan, 2025. Given all the euphoria, not sure even he knows what needs to be done! Analysts and fund managers seems to have more ideas than him :-)

[6] Analyst consensus earnings expectations function more like a sentiment indicator -- basically giving a contrarian signal rather than a fundamental justification to be bullish or bearish. Data for US investors but likely valid across all markets!

[7] Lithium Costs are falling as rapidly as Solar in the 2010s

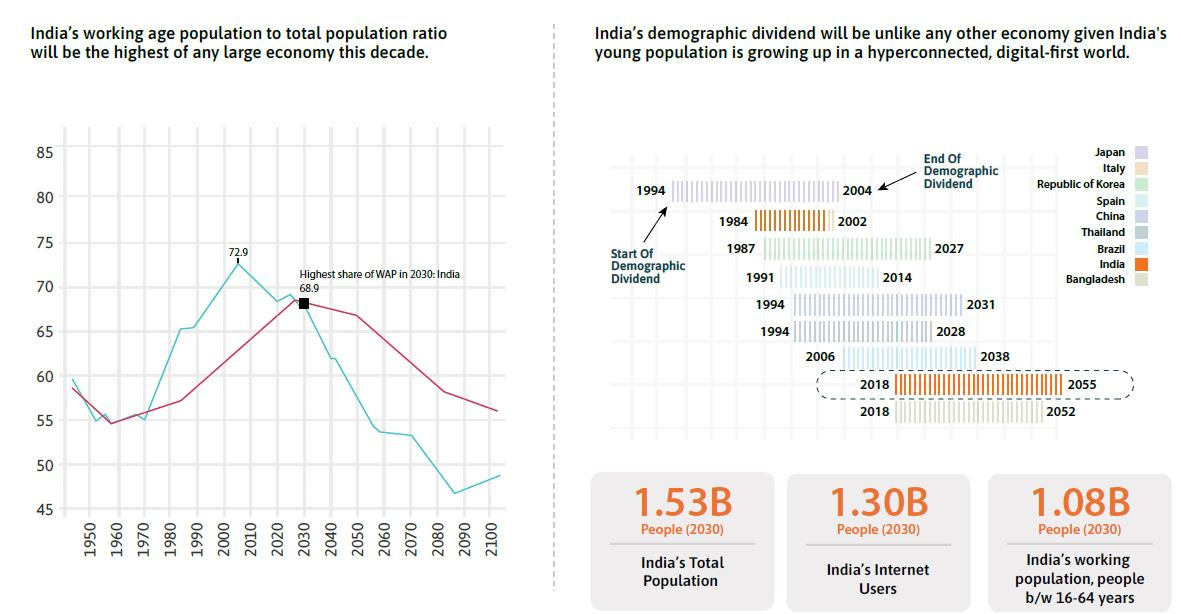

[8] By 2030, 1 in every 4 workers will be Indian. India’s booming population has now entered its prime. This decade, India will be the biggest supplier of digitally-savvy, working people to the global workforce

Source : Kalaari Capital

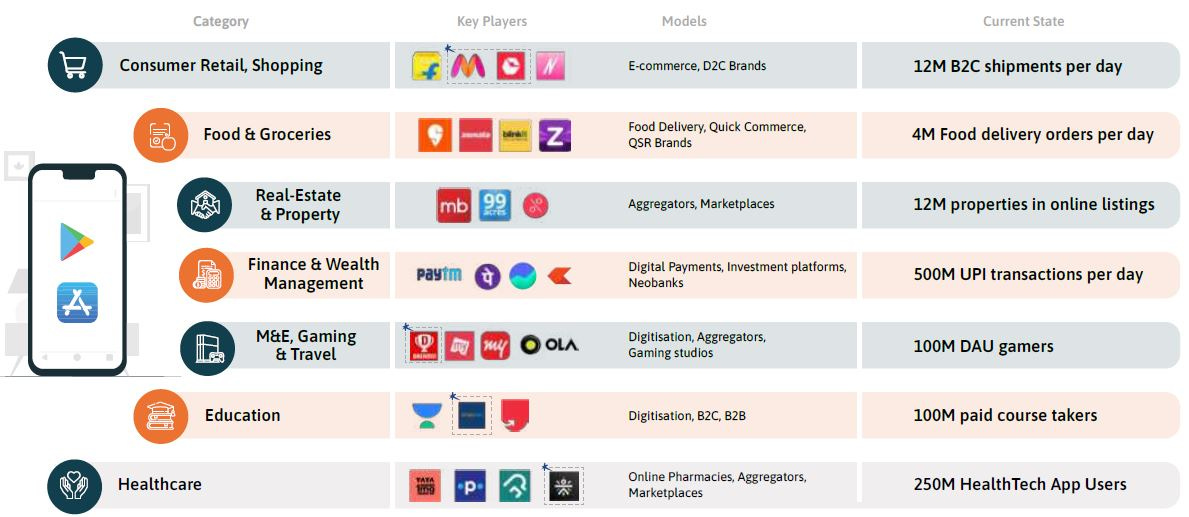

[9] Indian startups have defined the new, digital way of life for Indians. Thanks to the smartphone boom and the ‘Jio-fication’ of mobile data, Indians use an app for RKM++ (Roti-Kapda-Makaan* & more) today.

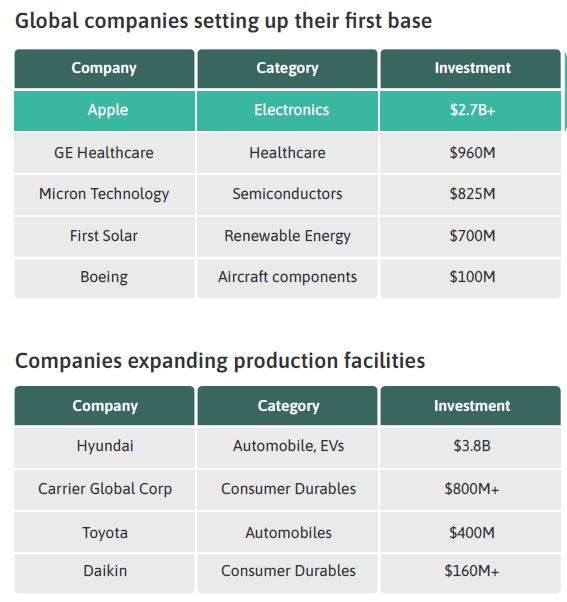

[10] Leading Global manufactures are coming to India!

Source : Kalaari Capital

This newsletter is for information and educational purposes only. In this material, Amit Kumar Gupta (SEBI registered Research Analyst, INH100009327) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the RA may or may not have any future or existing position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them. Past performance on charts may or may not be sustained in the future and should not be used as a basis for comparison to infer any investment ideas