AKG weekly charts - Issue #148

This newsletter is a weekly selection of 10 charts hand-picked across the internet and research reports which pertains to our investment strategy and bring an updated insight and perspective.

Connect on various social media platforms here

FC Investment outlook presentation for 2025 and 2024 review here [Visit www.fintrekkcapital.com for subscription details]

Dec’24 review of our equity research strategy- Special Situation & Wealth Compounders. [Visit www.fintrekkcapital.com for subscription details]

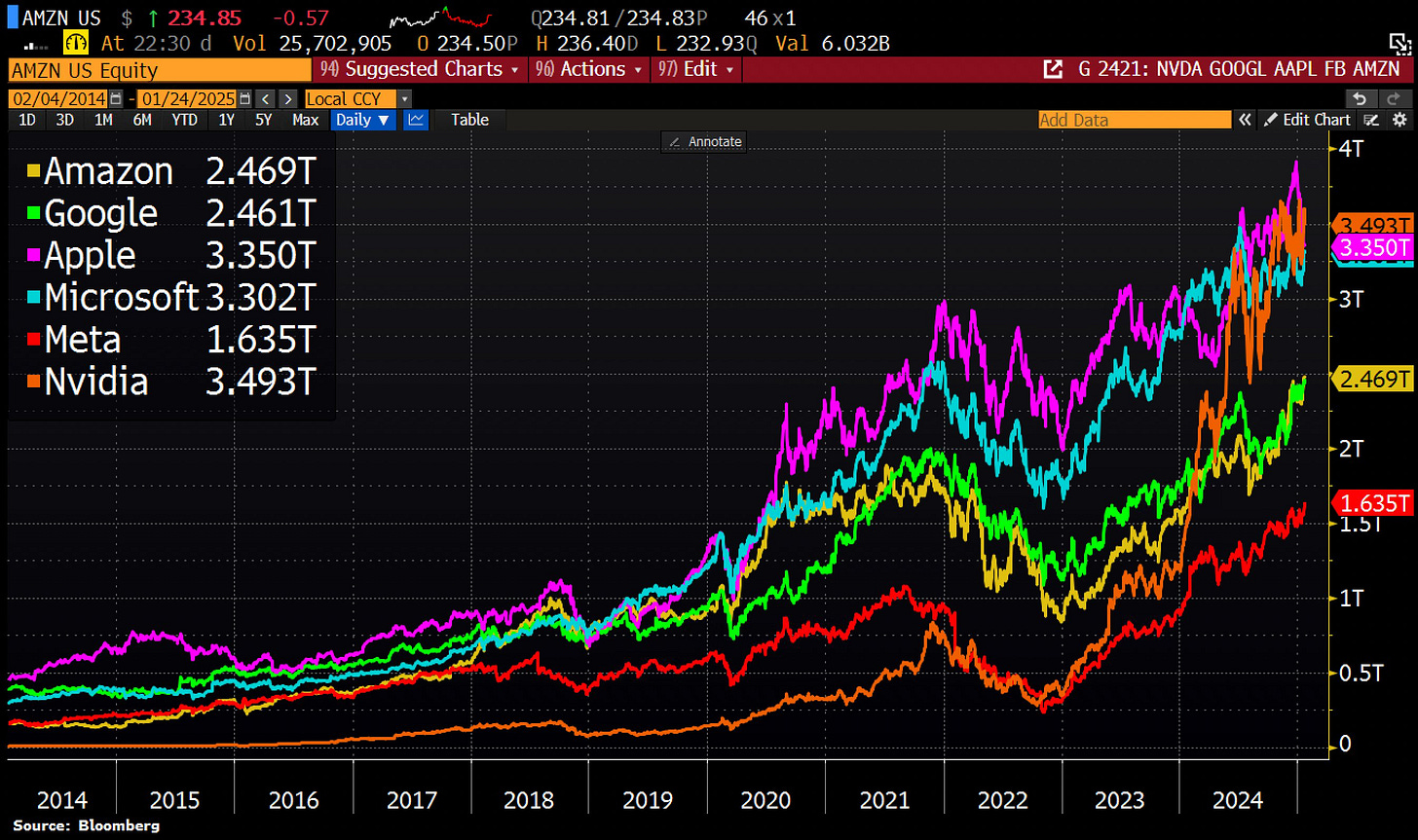

[1] China’s DeepSeek could represent the biggest threat to US equity markets as the company seems to have built a groundbreaking AI model at an extremely low price and w/o having access to cutting-edge chips, calling into question the utility of the hundreds of billions worth of capex being poured into this industry.

[2] Trump spoke about America’s decline. However, the US share of global GDP has actually increased from 22% to 26% in recent years. If you’re looking for a real example of decline, take a look at Germany, where share of global GDP has dropped from 5% to 4% over past decade.

[3] Energy has been by far the best-performing sector during the Biden administration.

[4] China’s trade surplus soars to $1tn in 2024, 21% higher than the previous year, as exporters rushed to make up for sluggish demand at home and get ahead of Donald Trump’s return to the White House.

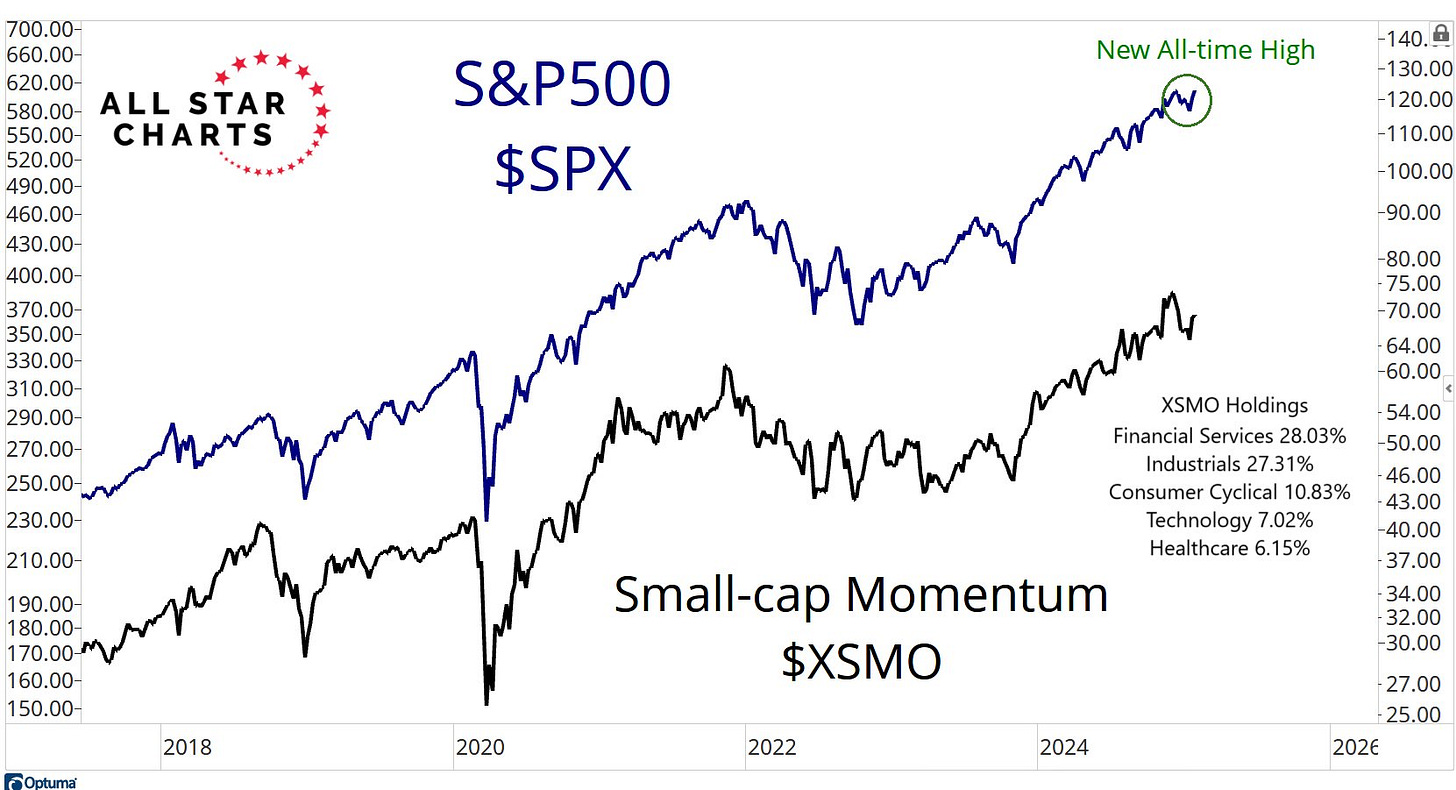

[5] Small-cap Momentum is outperforming all the large-cap indexes so far this year. This is all part of the rotation that continues to drive markets.

[6] ICICI Bank - Another steady quarter; asset quality ratios stable

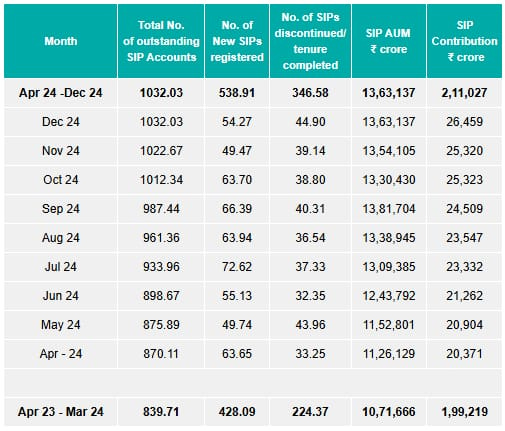

[7] While the aggregate number of SIPs is encouraging, the internals are bothersome. The number of SIPs discontinued is alarmingly high. Average age of an SIP in about 2.5 years. In December 2024, about 45% of SIPs were discontinued.

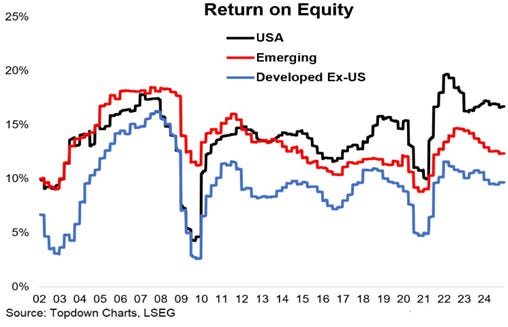

[8] Will the RoEs in US market finally correct in 2025?

[9] New tax regime may not be a major headwind for life insurance premium growth. Potential removal of 80C benefits under new tax regime unlikely to significantly impact life ins premium growth, as 80C contributes just ~5% of indvidual new biz premiums.

[10] After increasing steadily since the mid-1900s, the trade share of US GDP has declined over the past 15 years

Disclaimer : This newsletter is for information and educational purposes only. In this material, Amit Kumar Gupta (SEBI registered Research Analyst, INH100009327) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the RA may or may not have any future or existing position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them. Past performance on charts may or may not be sustained in the future and should not be used as a basis for comparison to infer any investment ideas