AKG weekly charts - Issue #149

This newsletter is a weekly selection of 10 charts hand-picked across the internet and research reports which pertains to our investment strategy and bring an updated insight and perspective.

Summary of financial markets in last week here.

Connect on various social media platforms here

Union Budget FY26 review here [Visit www.fintrekkcapital.com for subscription details]

Subscribe (free) to #AKGweekendreadings here [Newletter released every Friday]

[1] The Top 1% buy stocks and the Bottom 50% don't. Story of US market participation!

India’s Union Budget for FY26 was released on 1st Feb, 2025. Following charts bring out certain key macro and budgetary allocations from the budget.

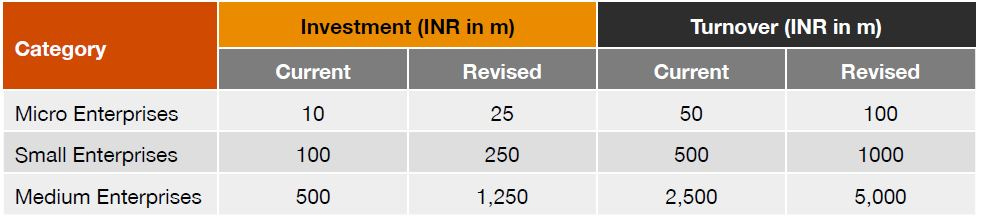

[2] The coverage and scope of Micro, Small and Medium Enterprises (MSMEs) is proposed to be broadened, and investment and turnover criteria are to be enhanced in the Union Budget FY26

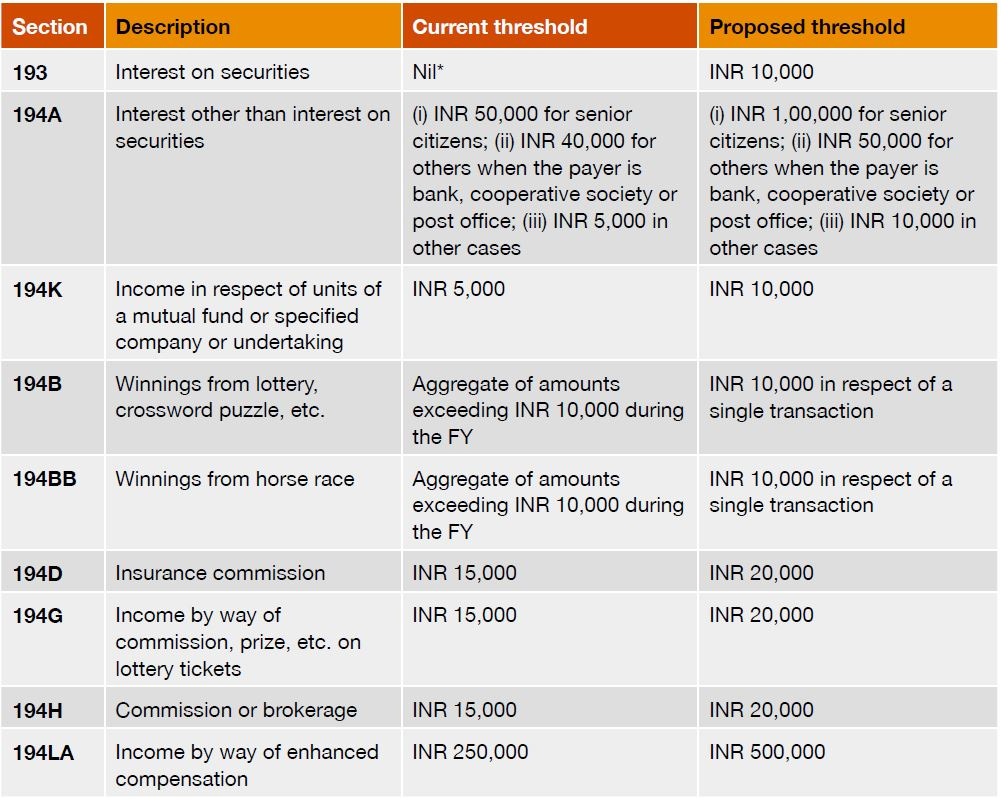

[3] Revision of thresholds applicable to TDS effective from 1 April, 2025

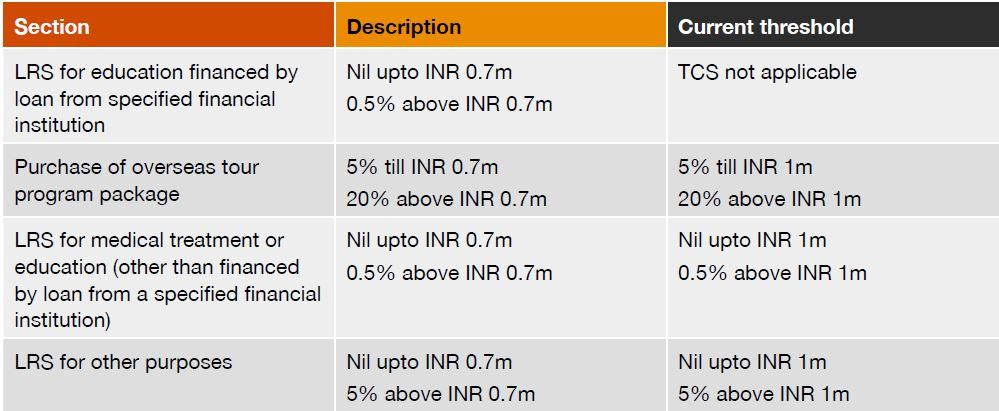

[4] Relaxation of threshold for TCS on LRS effective from 1st April, 2025

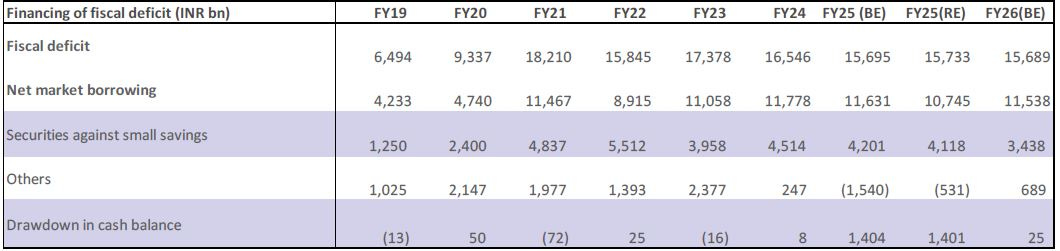

[5] The net market borrowing number for FY25 has been lowered by INR 800 bn compared with budget estimates. For FY26 the number is INR 115 tn, broadly in line with expectations.

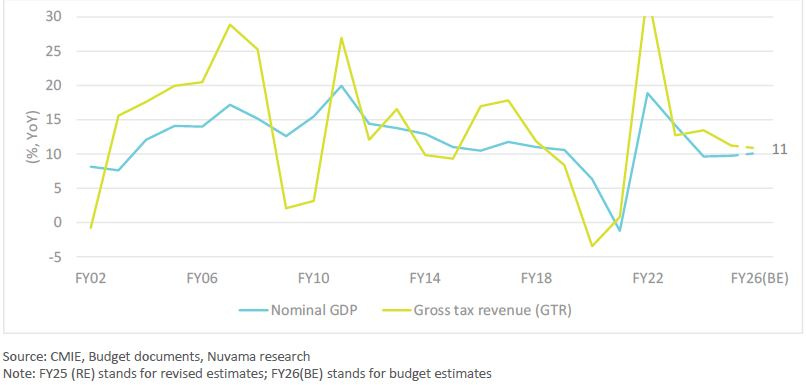

[6] Post covid tax revenues outpaced Nominal GDP growth significantly. However, the growth differential has been progressively reducing as Nominal GDP growth has moderated. Historically as well, tax buoyancy is a function of business cycle Given the weak NGDP growth, can tax buoyancy (adjusted for tax cuts) improve in FY26?

[7] Government’s capex spending on its own balance sheet is likely to remain benign in FY26 around 10% for second straight year. Even including PSUs, the growth rates are quite moderate suggesting that best of the capex is now perhaps behind. Within capex, the allocations to core sectors (roads, railways, defence) are expected to very subdued around 3% for a second straight year. Outside these, growth is essentially coming from allocations to interest-free loan to states, discretionary amount with finance ministry (which has been unspent in past two years) and science & technology.

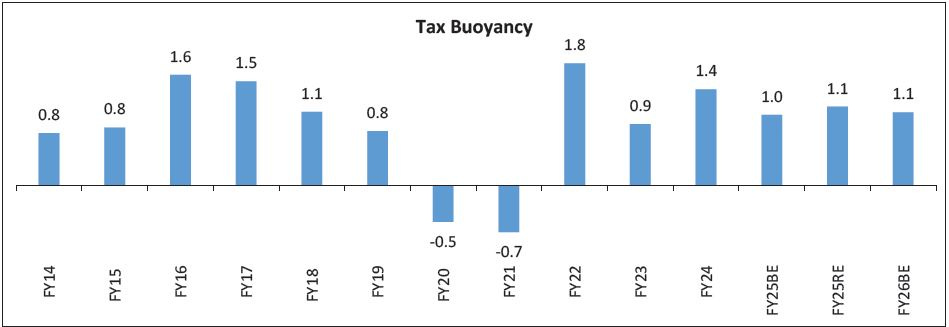

[8] The tax buoyancy (based on gross tax revenues) for FY26 is reasonably estimated at 1.1 as nominal GDP growth is projected by 10.1% while gross tax revenues are projected to grow by 10.8%. The tax buoyancy numbers look reasonable and are lower than the historical trends and thus, are likely to be more than achievable.

[9] The Government has revised FY25’s disinvestment target to Rs 33,000 crore from Rs 50,000 crore budgeted previously. Furthermore, the target for FY26 has been set at Rs 47,000 crore as Government is missing its disinvestment targets for the sixth consecutive year!

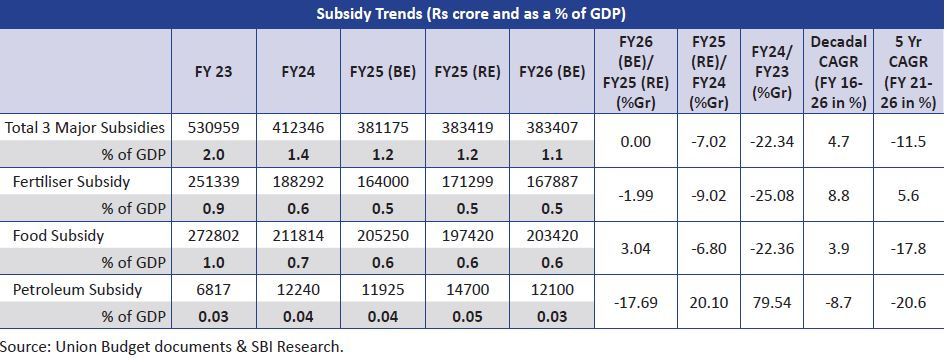

[10] The subsidy expenditure under three major heads will remain stagnant at Rs 3.8 lakh crore for FY26. Except from food subsidy, as compared to FY25 (RE) all other subsidies are postulated to decline.

Disclaimer : This newsletter is for information and educational purposes only. In this material, Amit Kumar Gupta (SEBI registered Research Analyst, INH100009327) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the RA may or may not have any future or existing position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them. Past performance on charts may or may not be sustained in the future and should not be used as a basis for comparison to infer any investment idea