AKG weekly charts - Issue #150

This newsletter is a weekly selection of 10 charts hand-picked across the internet and research reports which pertains to our investment strategy and bring an updated insight and perspective

[1] Germany which has regained some ground in global stock markets as US dominance has weakened over the past 2mths due to the underperformance of the Mag7 stocks. Germany now makes up >2% of global stock market value again—still below its 4.3% share of global GDP.

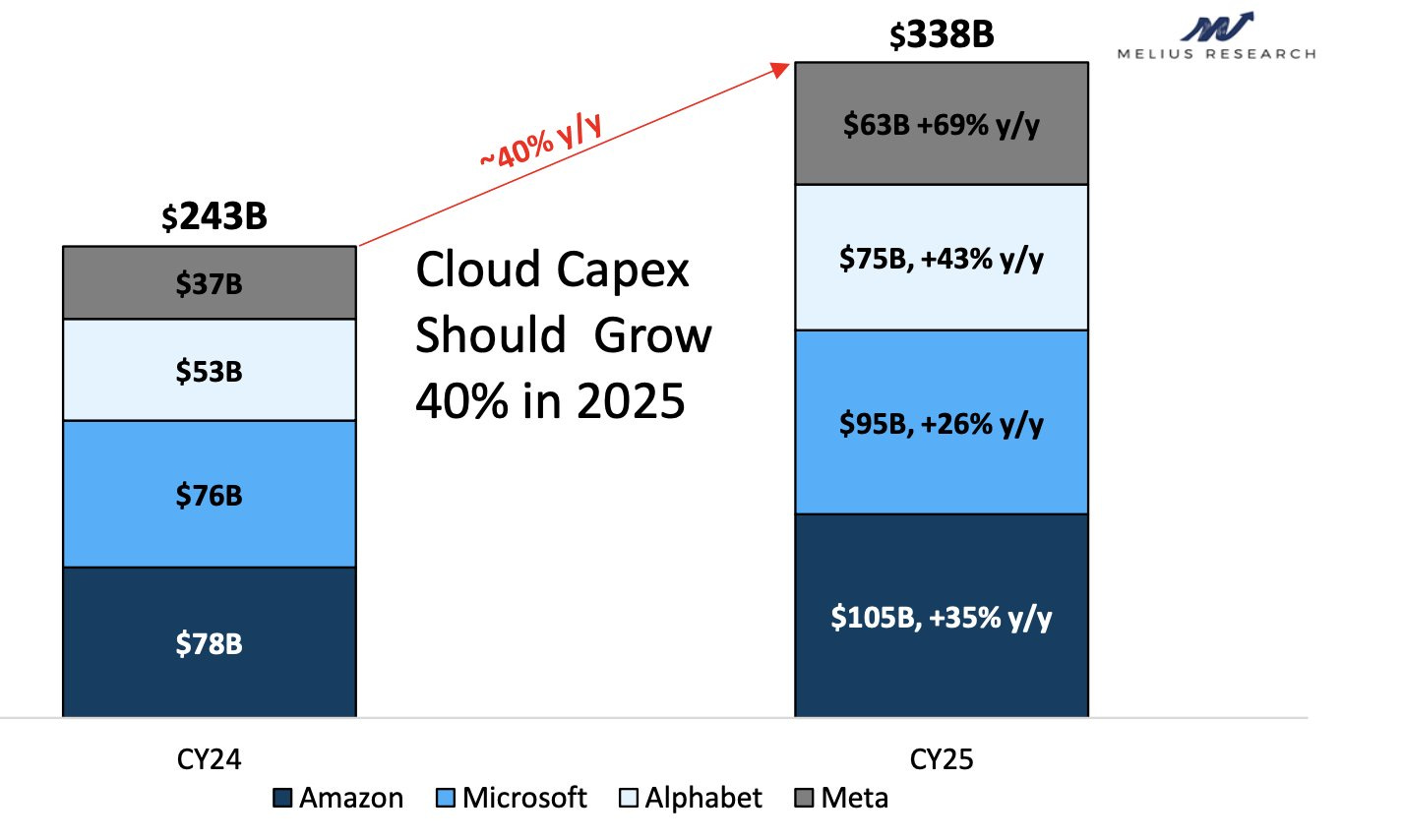

[2] Jevons' Paradox in action: The initial response to the "DeepFreak" suggests companies are spending more, not less. Cloud Capex is projected to grow 40% in 2025

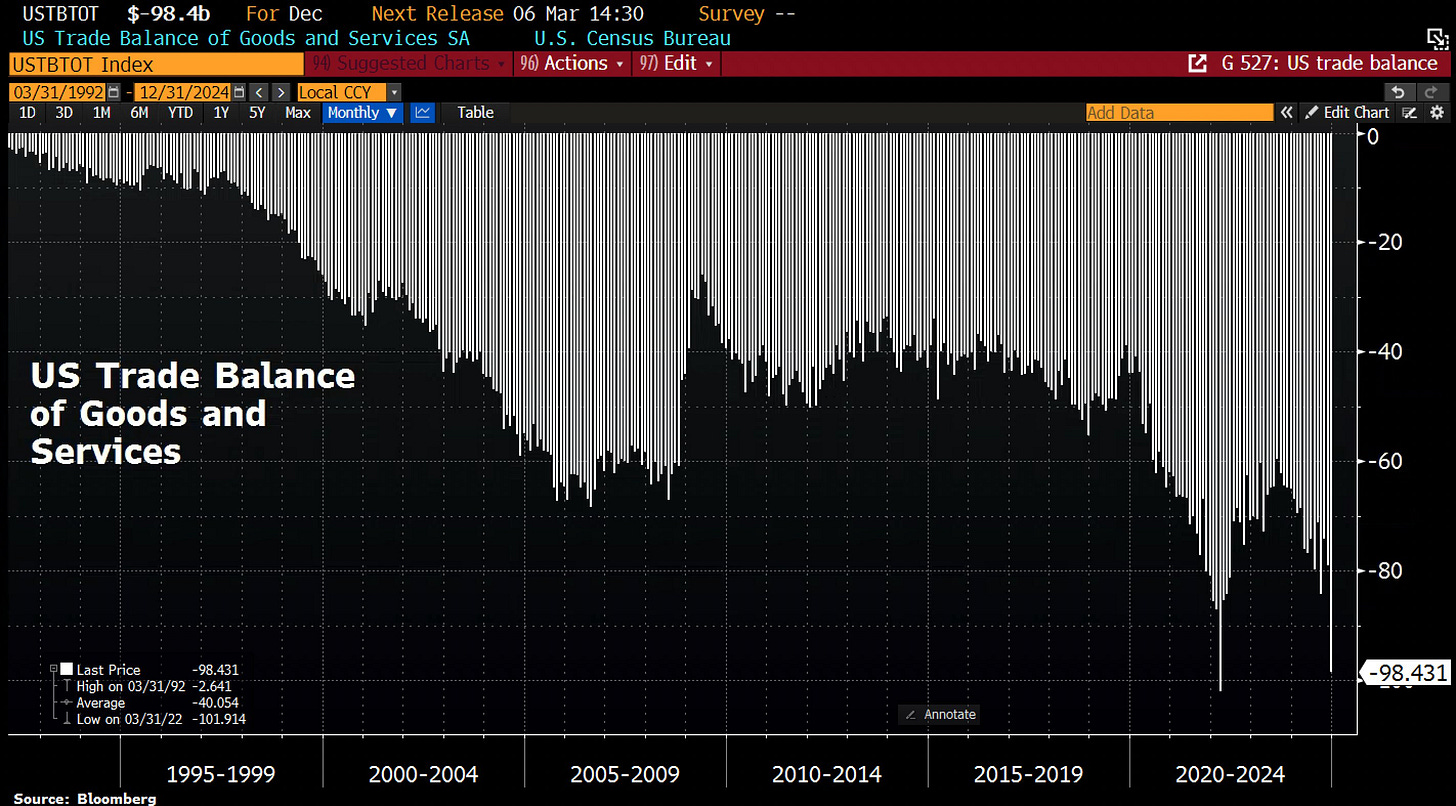

[3] US trade deficit widened sharply at the end of 2024, w/Dec shortfall in goods and services trade of $98.4bn, culminating in a full-year deficit of $918.4bn. Value of imports increased 3.5% in Dec, while exports fell 2.6%, w/a surge in inbound shipments of industrial products likely reflecting efforts to secure products in advance of Trump's tariffs. Trade deficit w/Mexico widened to a record $171.8bn for all of 2024, while the deficit w/Canada narrowed, and deficit w/China widened to $295.4bn

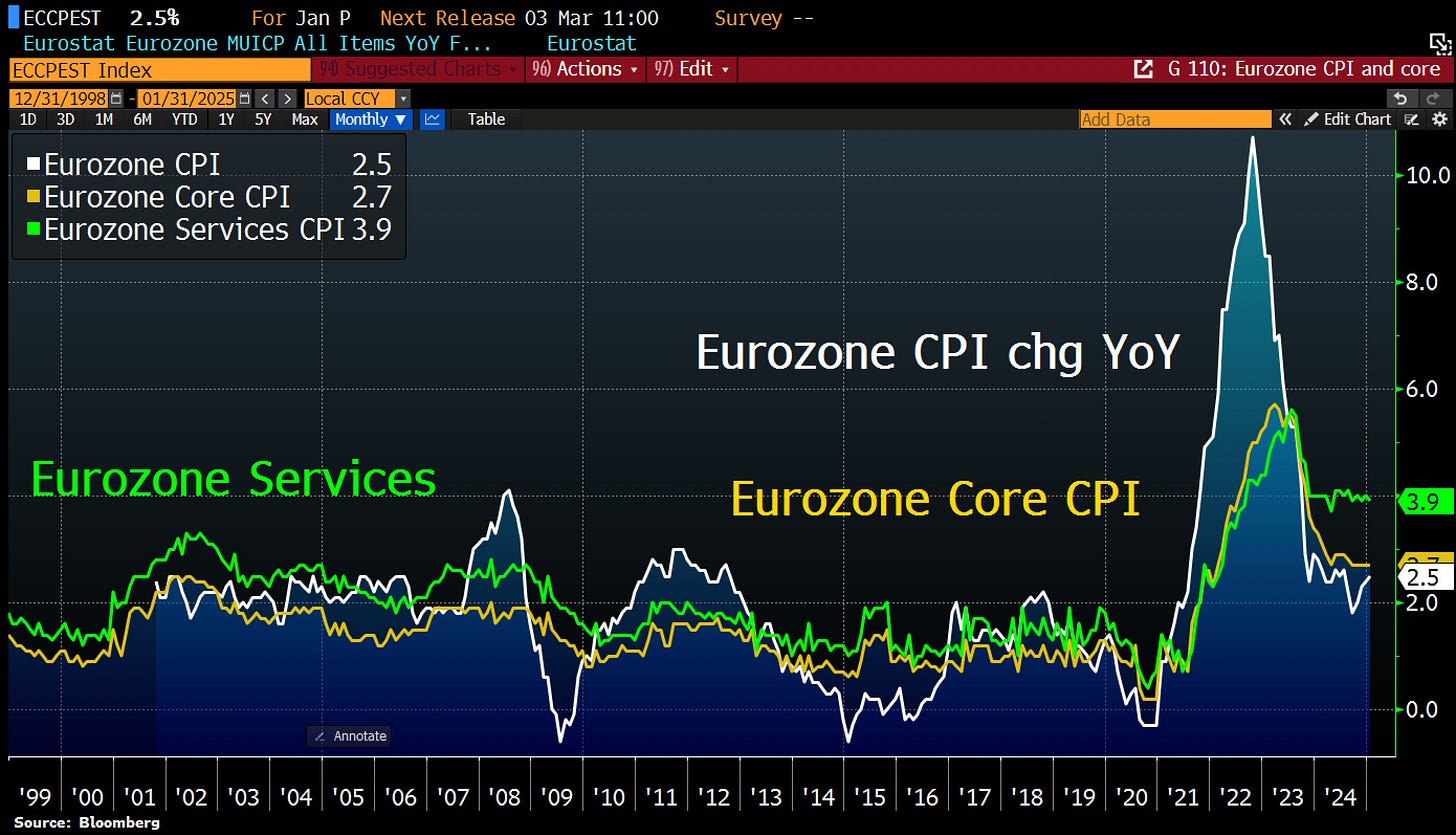

[4] Eurozone inflation unexpectedly accelerated to 2.5% in Jan from 2.4% in Dec. Core CPI remained high at 2.7%, while services sector price gains dipped slightly to 3.9% from 4%.

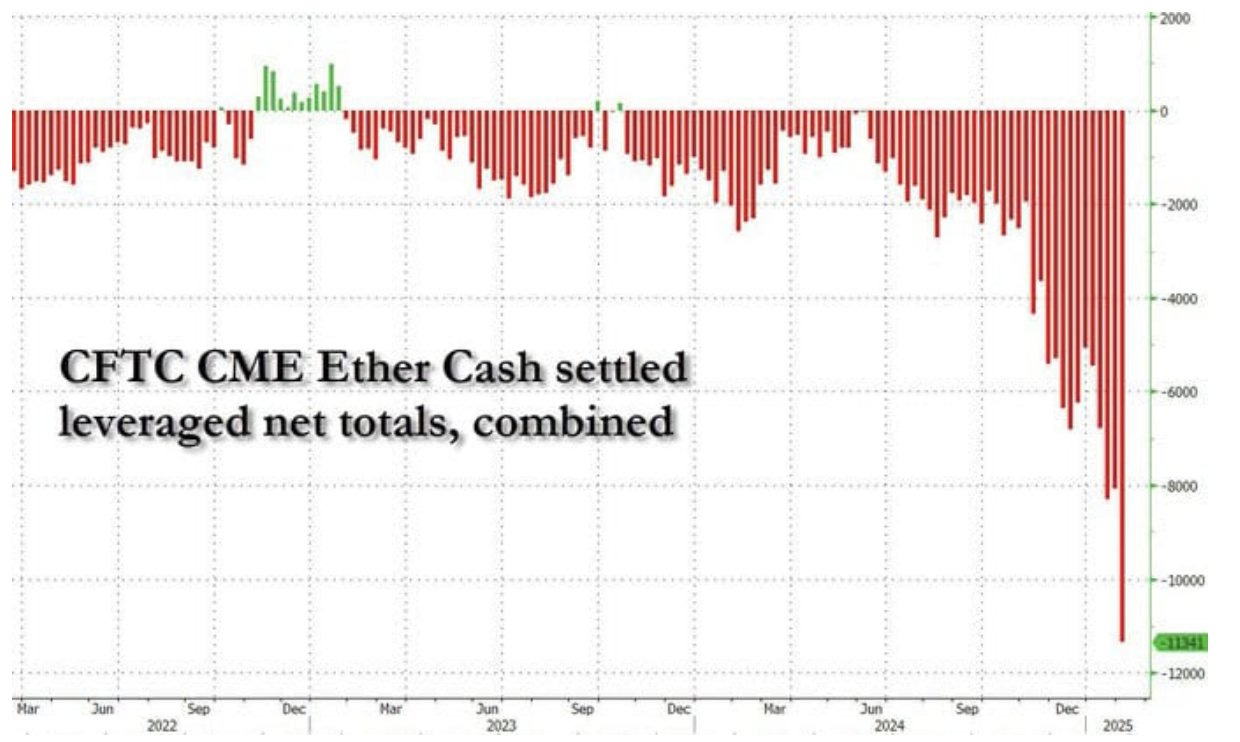

[5] Speculators have built the largest Ethereum short position in history

[6] Japan's Borrowing Costs have soared to the highest level in more than 14 years

[7] The US Fed has contracted its balance sheet by US$2.1trn since the beginning of its monetary tightening (QT) program in April 2022. The total assets held by the US Fed are now lowest since May 2020. It would need to unwind another US$2.7trn to completely undo the Covid related monetary expansion

[8] Gold has outperformed both S&P 500 and Nifty50 in the last 25 years since 2000. Gold outperformed S&P 500 in USD terms, growing 9.99x vs. 4.34x for S&P 500. Gold also outperformed the Nifty50 in INR terms, increasing 19.32x vs. 15.67x for Nifty50

Source : Aequitas

[9] Enabled primarily by architectural improvements in AI systems, performance per dollar of AI compute is expected to improve >1000x by 2030. At that time, we expect that compute performance will have doubled 64 times since the advent of the integrated circuit

[10] OpenAI could surpass $10 billion in revenue in 2025, monetizing at a faster rate than social media companies over the past decade. If the adoption of ChatGPT is an indicator, AI should drive rapid demand for a range of new technologies.

Disclaimer : This newsletter is for information and educational purposes only. In this material, Amit Kumar Gupta (SEBI registered Research Analyst, INH100009327) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the RA may or may not have any future or existing position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them. Past performance on charts may or may not be sustained in the future and should not be used as a basis for comparison to infer any investment idea