AKG weekly charts - Issue #151

This newsletter is a weekly selection of 10 charts hand-picked across the internet and research reports which pertains to our investment strategy and bring an updated insight and perspective

Summary of financial markets in last week here.

Connect on various social media platforms here

Mar’25 review of our equity research strategy- Emerging leaders, Special Situation & Wealth Compounders. [Visit www.fintrekkcapital.com for subscription details]

Subscribe (free) to #AKGweekendreadings here [Newletter released every Friday]

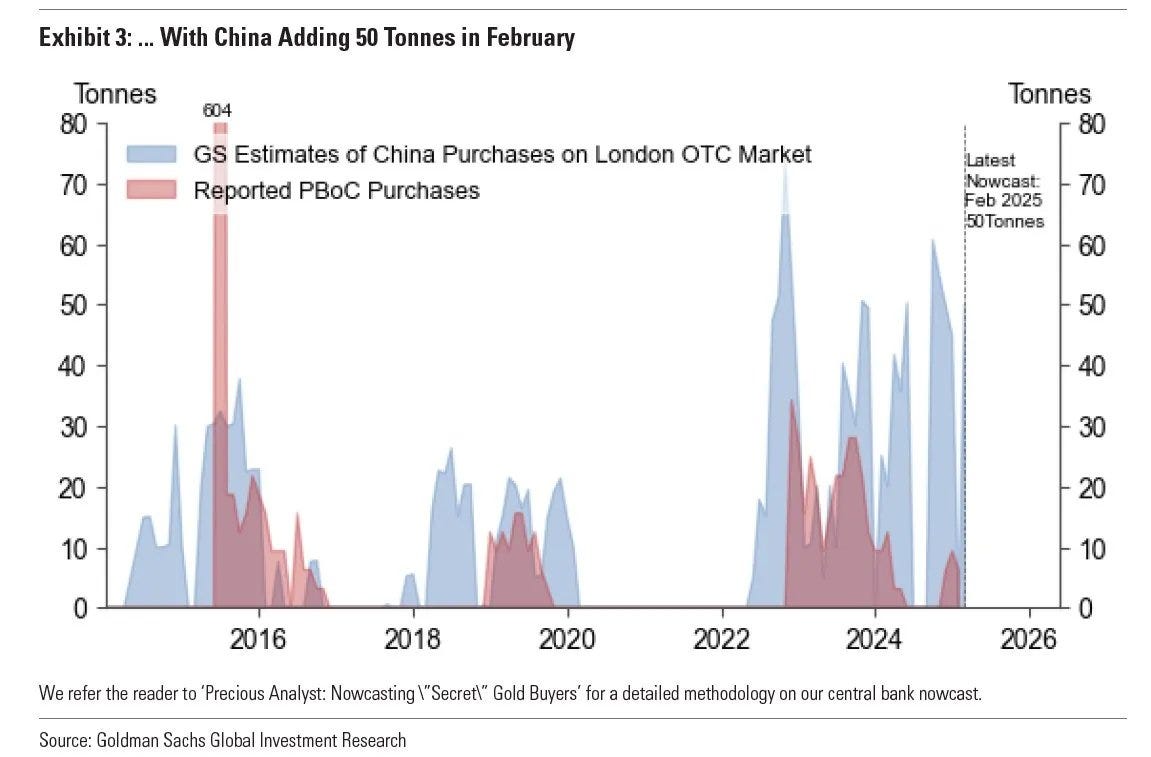

[1] “China reported 5 tonnes of gold purchases in February… China actually bought 50 tonnes of gold in February (per GS).“ (source). This makes a lot of sense, especially with Trump tariffs and increasingly hostile treatment of China by the USA — China is diversifying its FX reserves out of treasuries and into gold.

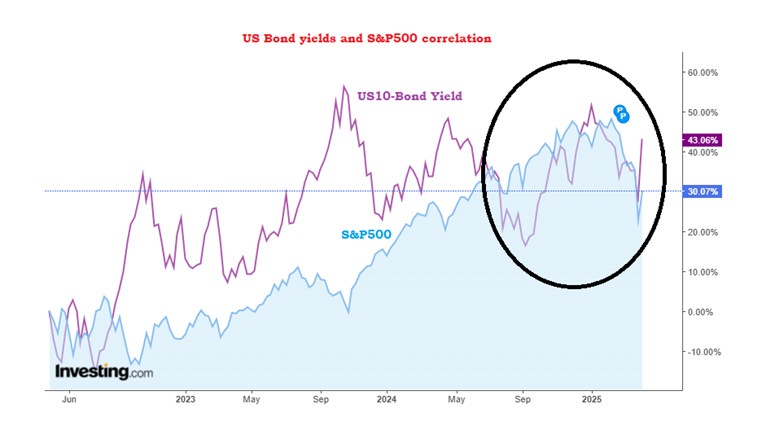

[2] There is plenty of recent evidence, pointing that the US bond yields are no longer a strong indicator of the economy and/or markets. For example, consider the case of the US yield curve inversion in 2022-23. See thread here

[3] HDFC AMC Q4FY25 earnings indicated the decline on average ticket size despite unique customers/market share remain stable. This implies higher churn among lower ticket size SIPers, money not strong enough to survive in volatility!

Disclaimer : Not a reco to buy or sell. No positions!

[4] The 40-day Advance/Decline (A/D) ratio has continued to rise from its most oversold condition since 2022 when Nifty hit 15200. This trend is encouraging for the market, indicating that the upward trajectory remains intact despite potential short-term volatility. Source : Strike Money

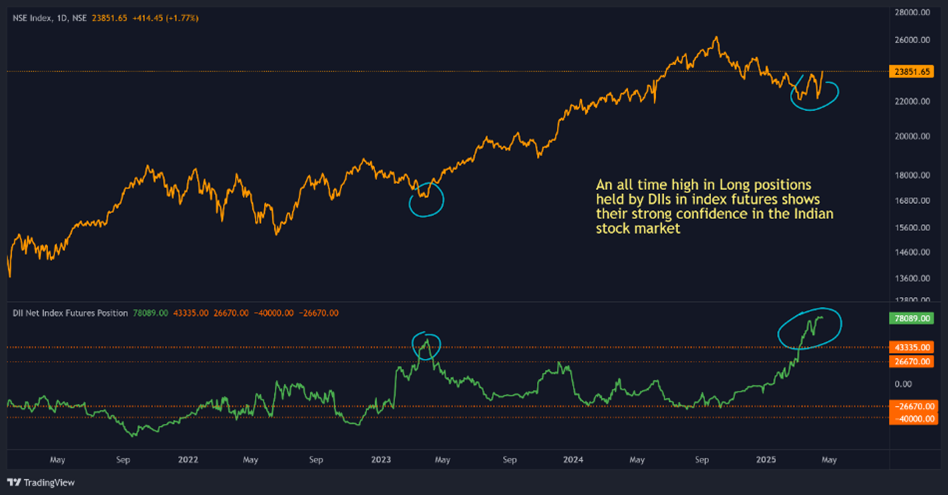

[5] DIIs have spent the entire period from March to April increasing their long positions in index futures. As of Wednesday, this week, their long positions reached an all-time high. Despite short-term volatility, this ongoing confidence reflects the strong belief shown by Indian institutions. This time, DIIs have your back.

Source : Strike Money

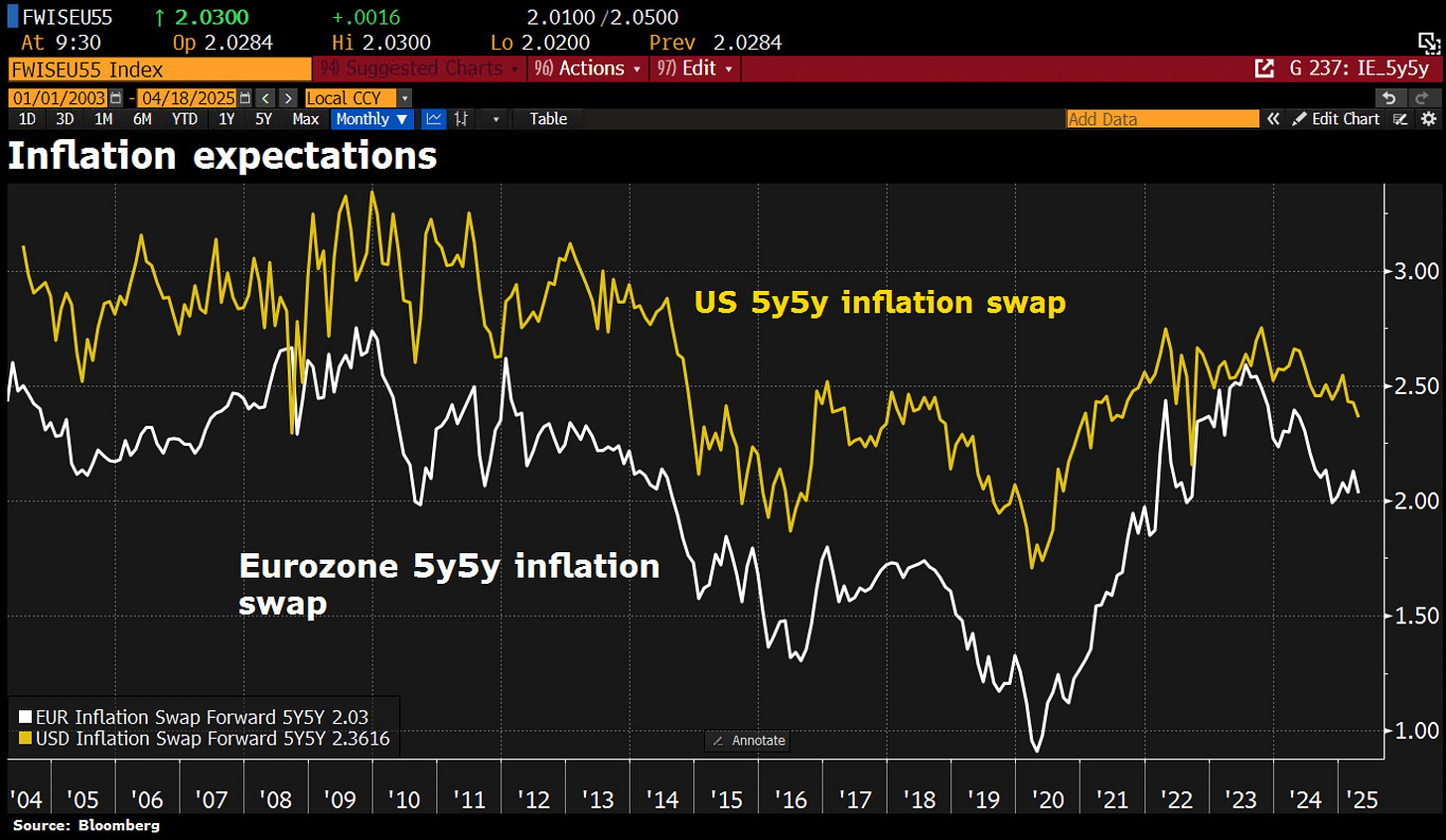

[6] Despite all the talk about tariffs, long-term inflation expectations have stayed stable — or even gone down. The so-called 5y5y inflation expectations are currently at 2.03% for Europe and 2.36% for the US.

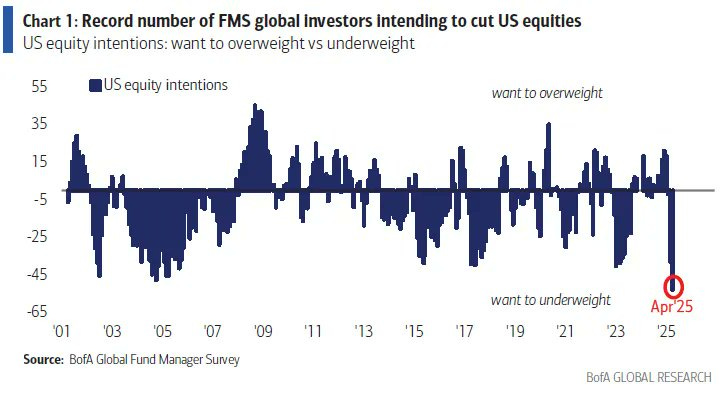

[7] Investors haven’t been this bearish in 30yrs, BofA poll shows. 82% of fund managers expect the global economy to weaken, and a record number intend to reduce exposure to US equities. BUT “peak fear” is not yet reflected in cash allocations, which currently stands at 4.8% of assets and would typically need to rise to 6%, BofA added.

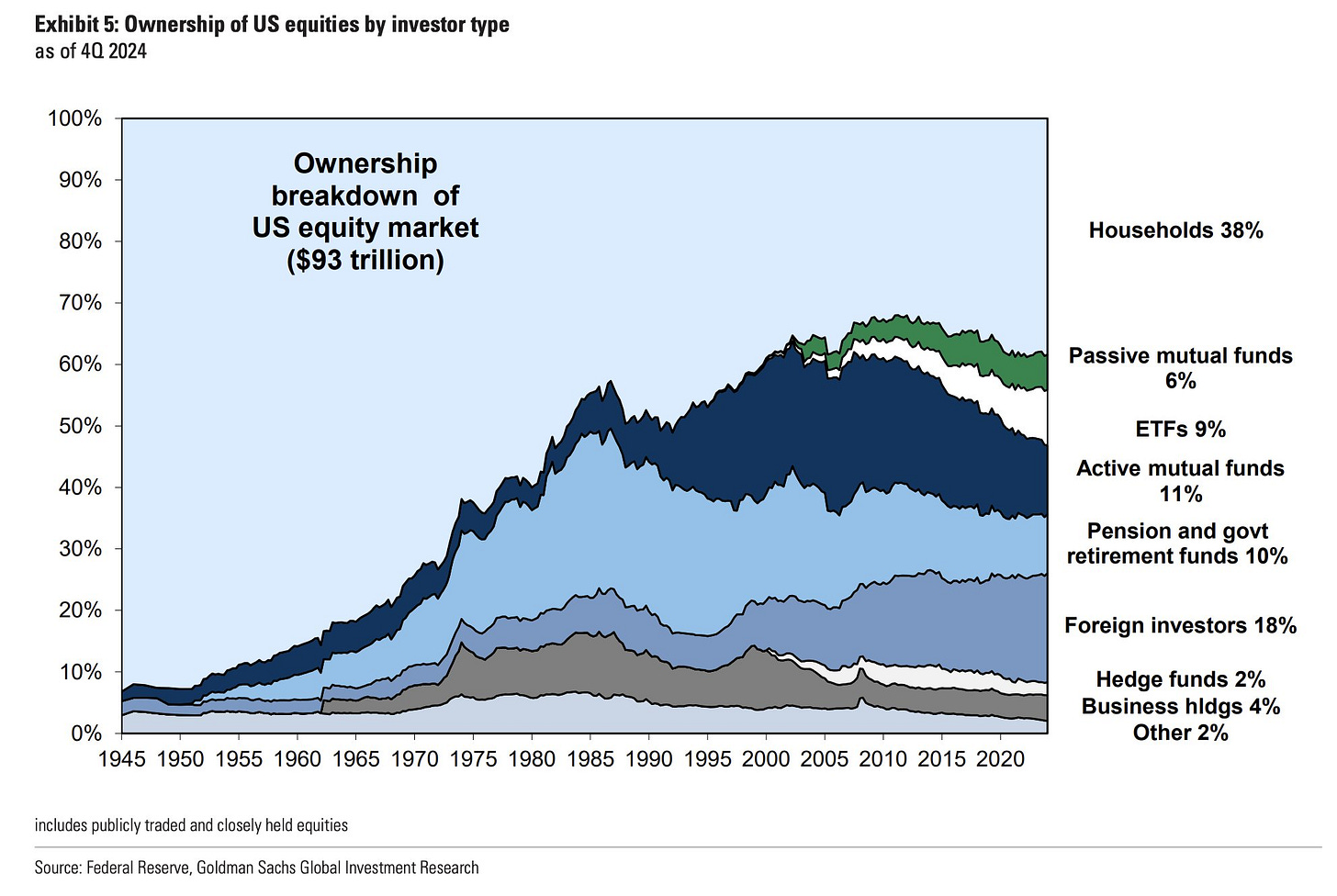

[8] Pension funds in Canada and Denmark are pulling back or hitting pause on their US investments, citing concerns over Trump’s unpredictable policy decisions. It’s a notable shift, especially considering how much the US stock market relies on global investors. As of early 2025, foreign investors own a record 18% of U.S. equities. 49% come from European investors, and 25% from the Americas.

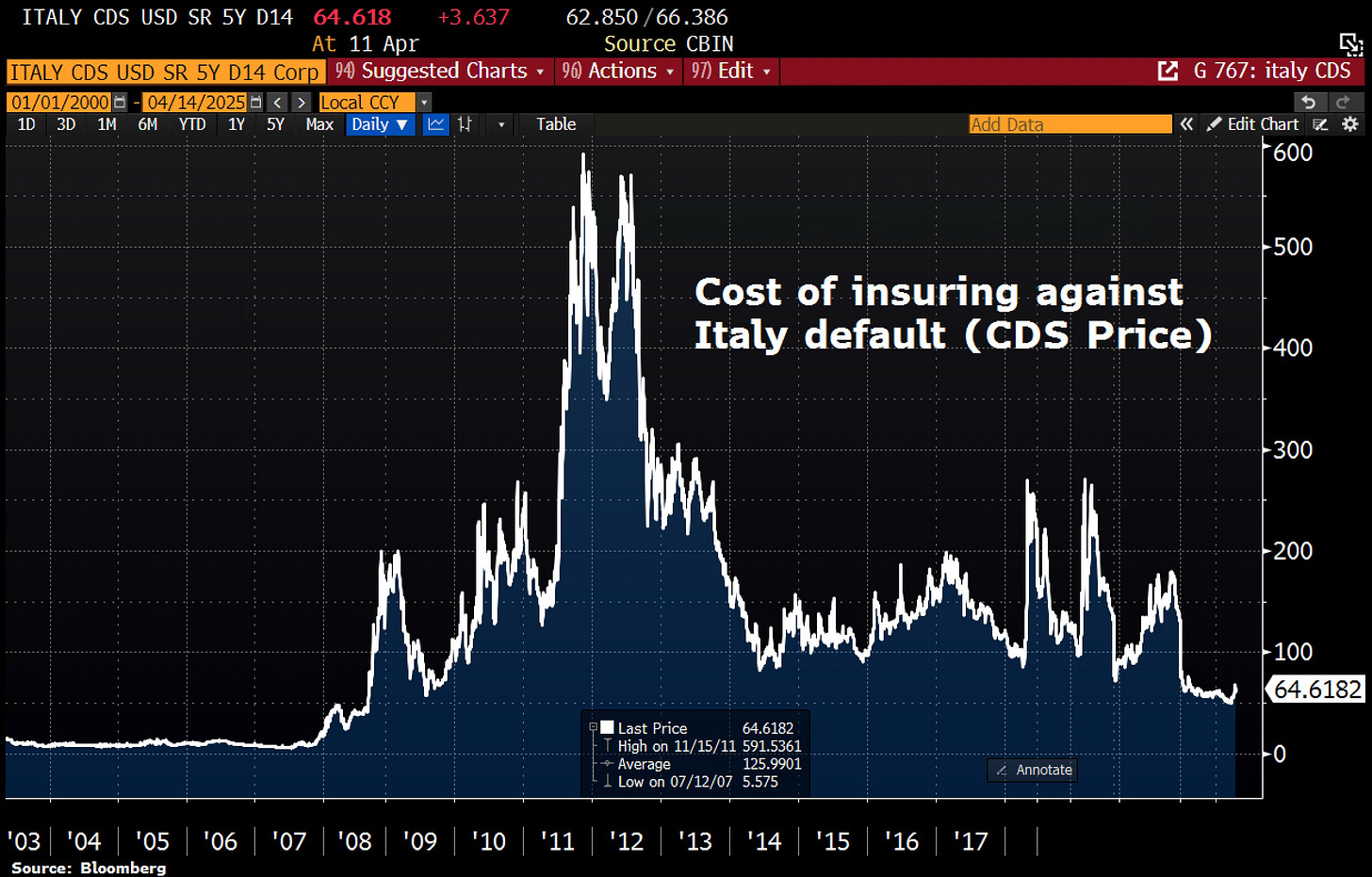

[9] S&P has upgraded Italy’s credit rating from BBB to BBB+, marking another win for PM Meloni. The upgrade highlights Italy’s progress in cutting its budget deficit and strengthening public finances. S&P expects the deficit to drop <3% of GDP by 2027. The new rating is now 3 steps above junk status. Meanwhile, credit markets—based on CDS prices—are putting Italy’s chance of default at 5.6%.

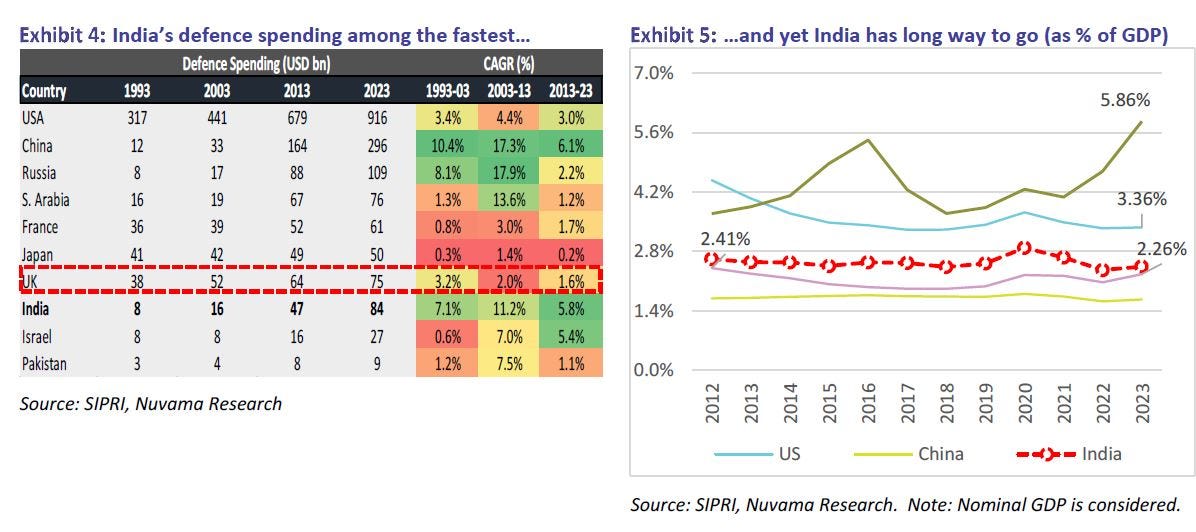

[10] India’s long-term defence growth story is intact given the GoI’s push to build out the local defence ecosystem to be self-reliant. It would not only cater to domestic market, but also exports-related demand. Despite the recent spending, it remains low as a % of the GDP

Disclaimer : This newsletter is for information and educational purposes only. In this material, Amit Kumar Gupta (SEBI registered Research Analyst, INH100009327) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the RA may or may not have any future or existing position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them. Past performance on charts may or may not be sustained in the future and should not be used as a basis for comparison to infer any investment idea