AKG weekly charts - Issue #152

This newsletter is a weekly selection of 10 charts hand-picked across the internet and research reports which pertains to our investment strategy and bring an updated insight and perspective

Summary of financial markets in last week here.

Connect on various social media platforms here

Mar’25 review of our equity research strategy- Emerging leaders, Special Situation & Wealth Compounders. [Visit www.fintrekkcapital.com for subscription details]

Subscribe (free) to #AKGweekendreadings here [Newletter released every Friday]

[1] JP Mogran 4000$ forecast for Gold was in news last week. R:r from CMP seems negative. So fall likely first! PS : No reco to buy or sell

Underpinning our forecast for gold prices heading towards $4,000/oz next year is continued strong investor and central bank gold demand averaging around 710 tonnes a quarter on net this year. In our view, the macro environment remains ripe for both sustained elevated levels of purchases by central banks (900 tonnes forecasted in2025) as well as a further expansion in investor holdings, particularly from ETFs & China.

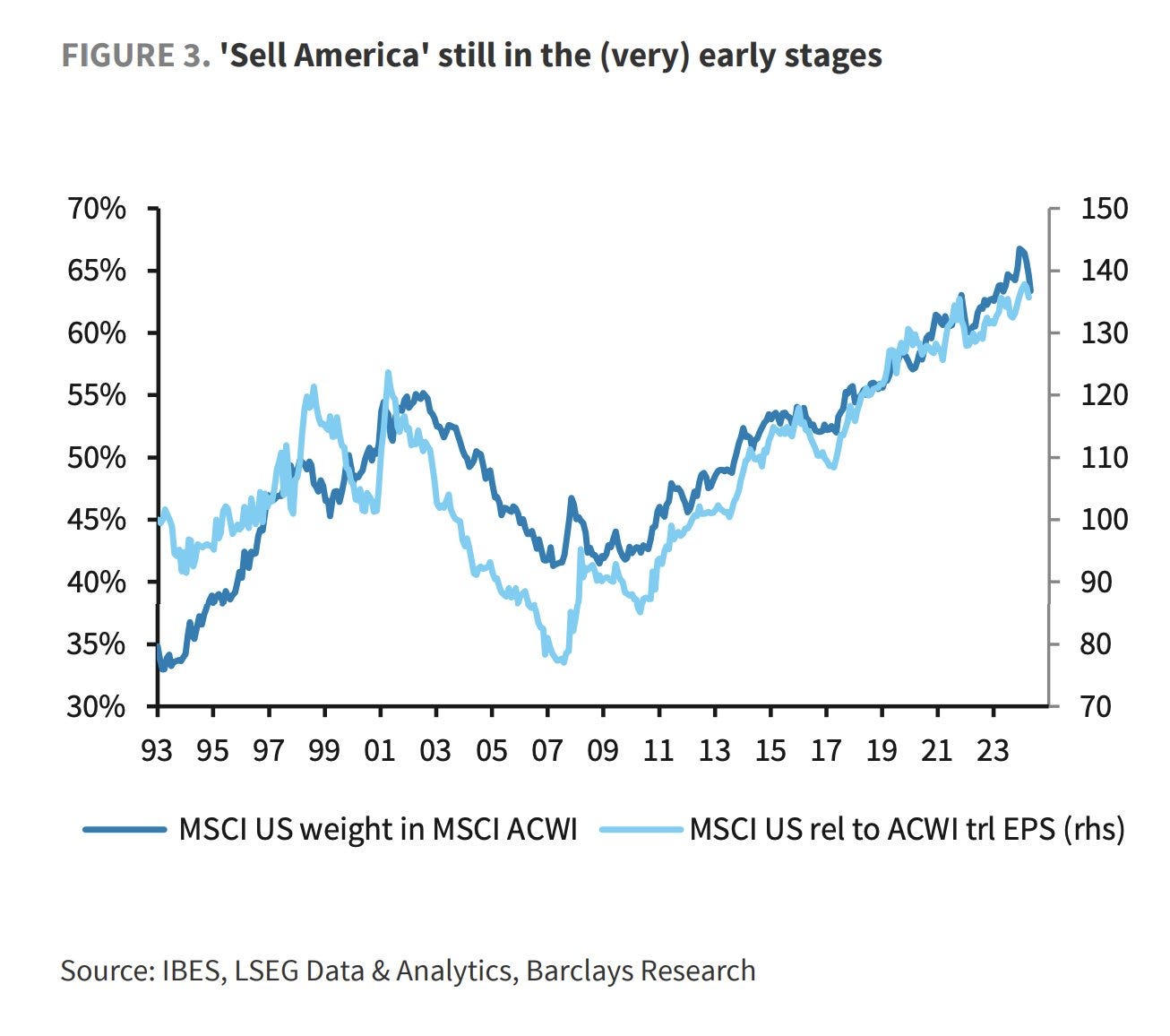

[2] 'Sell America' is still in the early stages. The US stock market still makes up a dominant 63% of global market value. A lot of that is due to Big Tech, which has been the cornerstone of the US exceptionalism trade, so upcoming results will be closely watched. (Source : Barclays)

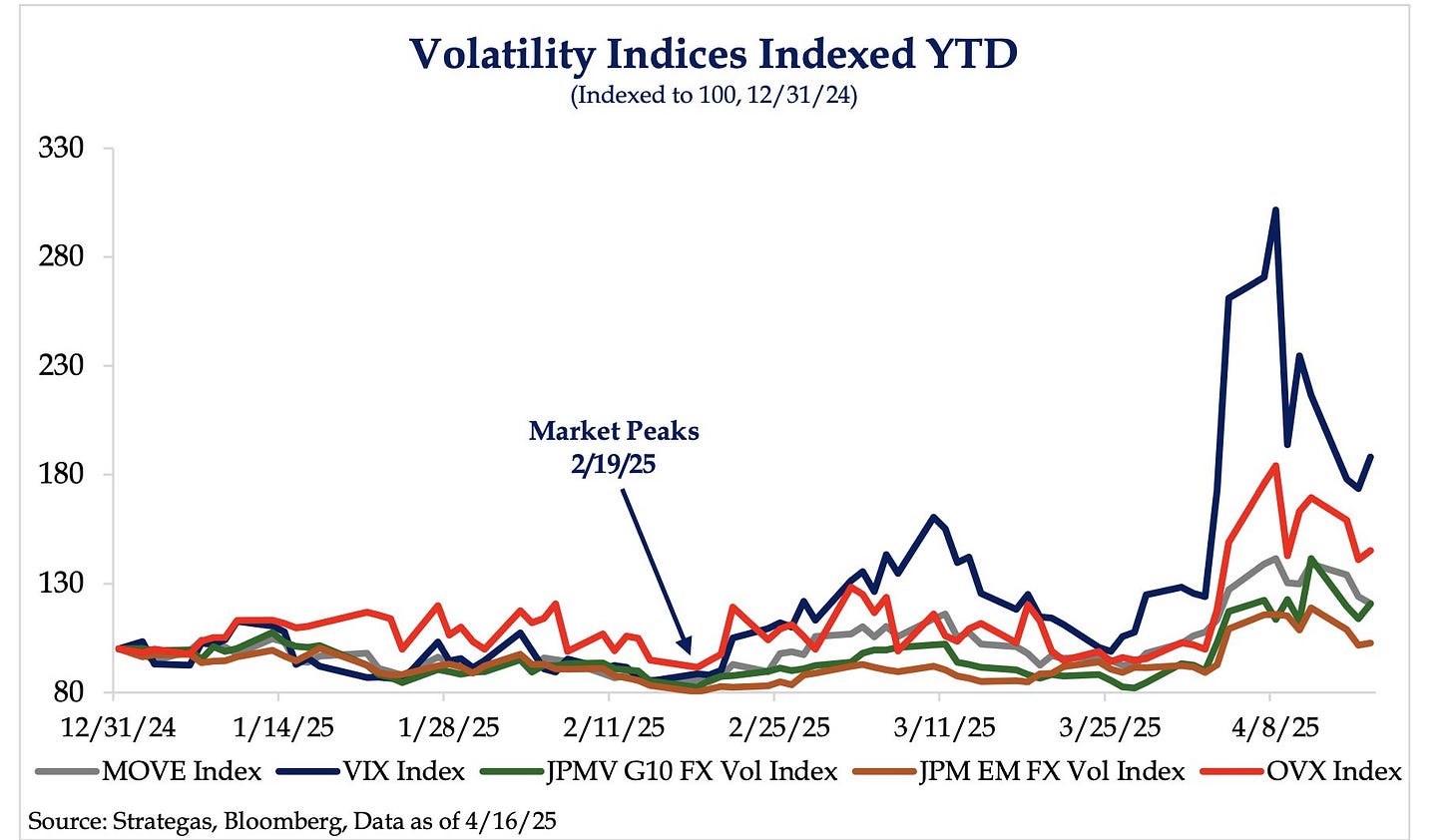

[3] This chart shows how much uncertainty driven by Trump affects all major asset classes — incl stocks, bonds, currencies, and oil. Stock market volatility is still leading the way, but what's more concerning is that volatility is rising across the board, which reflects the growing global uncertainty caused by US trade policy.

(Source : SRP)

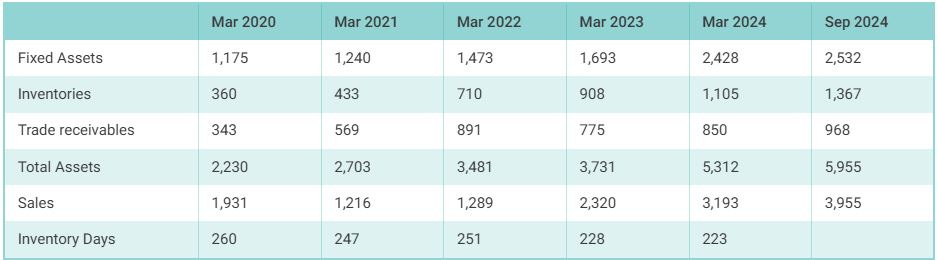

[4] RK Forge forensic investigation revealed discrepancies in the inventory records during the annual physical verification process that commenced on April 6, 2025. These discrepancies have the potential to impact the company’s net worth by approximately 4-5%. The company has hinted that the promoters would fund the potential adverse impact using permissible instruments under applicable laws. However, given the substantial financial impact, there are concerns that the company might resort to either increased debt or equity dilution to bridge the gap in its net worth. This raises risks for existing investors regarding share dilution and a reduced equity value

PS : NO recommendation to buy or sell the stock.

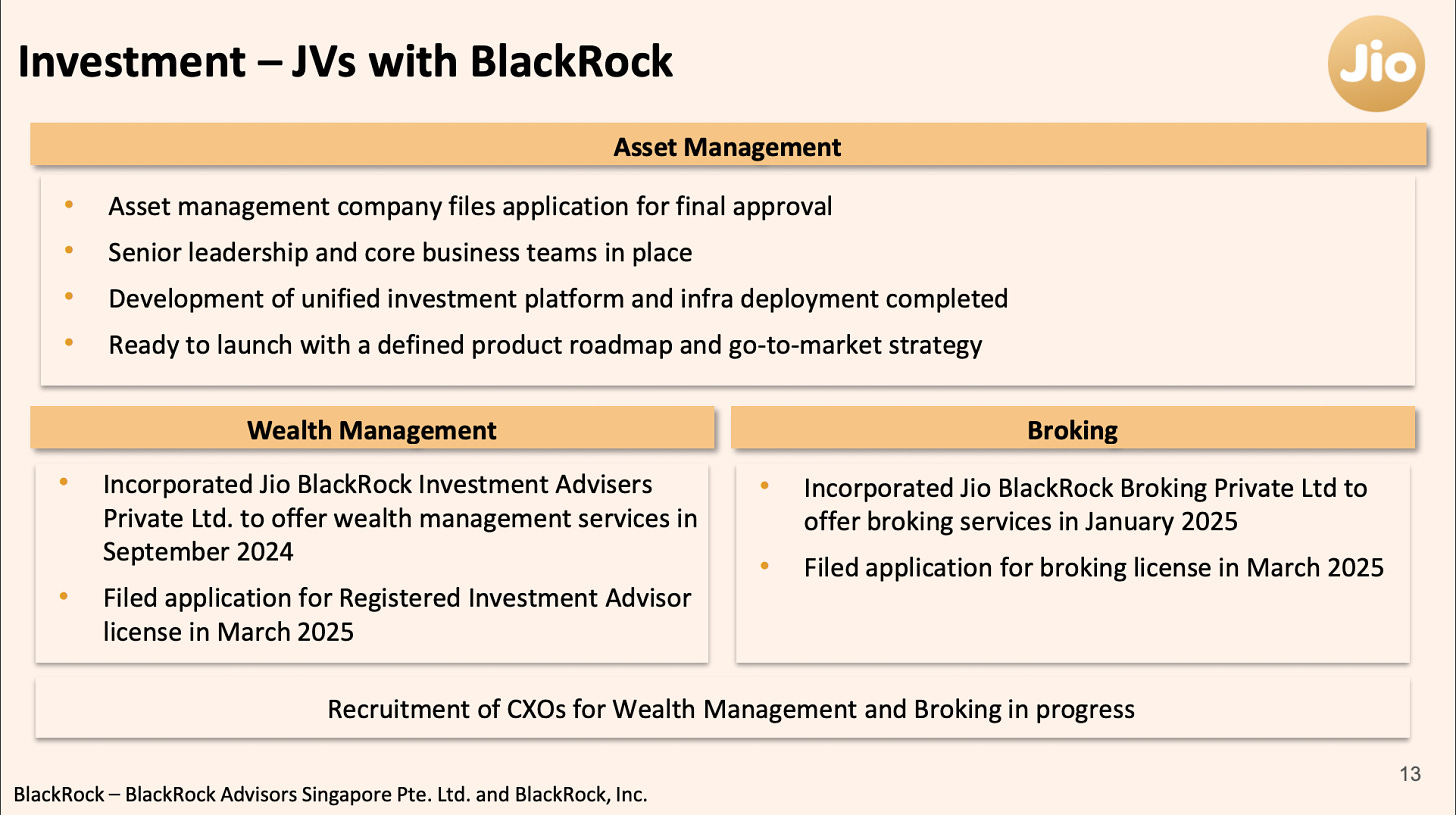

[5] Jio's joint ventures with BlackRock present significant growth opportunities in asset management, wealth management, and broking, targeting India's expanding retail investor base and affluent clientele. The partnership leverages BlackRock’s expertise and Jio's digital infrastructure to capture a larger market share in these high-growth sectors.

PS : NO recommendation to buy or sell the stock.

[6] Waaree has provided an EBITDA guidance of INR 5,500 crores to INR 6,000 crores for FY26. The company's strategic investments in backward and forward integration, including upcoming facilities for battery storage and green hydrogen, are expected to drive long-term growth.

PS : NO recommendation to buy or sell the stock.

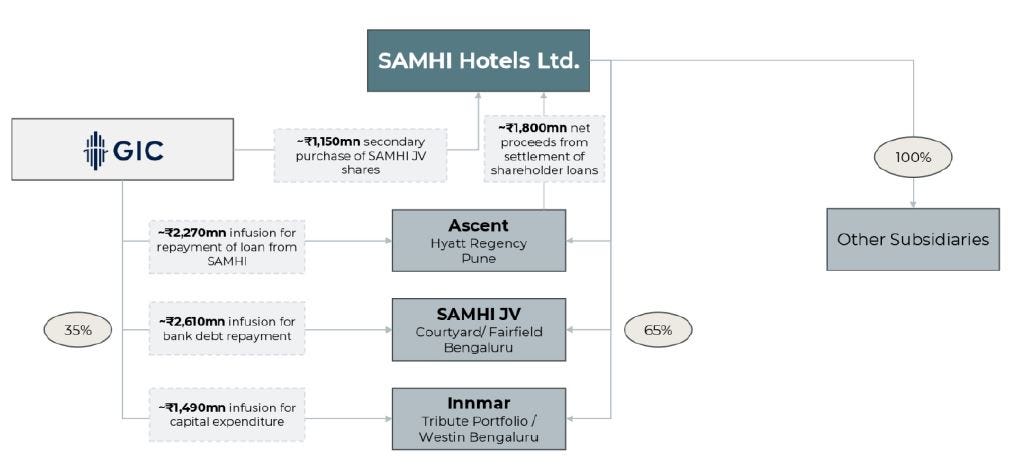

[7] The infusion of Rs7.5 bn of equity by GIC will likely address street concerns about the leverage of SAMHI, besides bringing on board a credible sponsor who could support growth ambitions in the future

PS : NO recommendation to buy or sell the stock.

[8] The final guidelines on LCR come as a net positive compared to the draft regulations. The RBI’s assessment suggests an improvement of six percentage points in the LCR ratio, but at an aggregated level. The changes are harder to calculate for individual banks based on current disclosures. We assess a 2-3% point lower deposit requirement if LCR is moved back to current levels. This would imply that banks can (1) accelerate loan growth, (2) lower deposit mobilization and/or (3) cut deposit rates with greater confidence

PS : NO recommendation to buy or sell financials

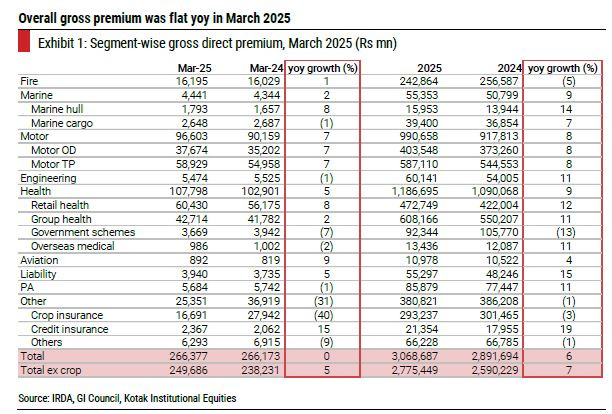

[9]The GWP growth was weak in March 2025 and 4QFY25 for the non-life insurance industry. Weakness in motor and commercial lines has persisted, while retail health reels under the pressure of the 1/n rule. ICICI Lombard reported muted 2% yoy GWP growth due to the abovementioned factors. Star Health also reported muted 3% yoy GWP growth, as moderate retail health was offset by weakness in the group business

PS : NO recommendation to buy or sell any stock.

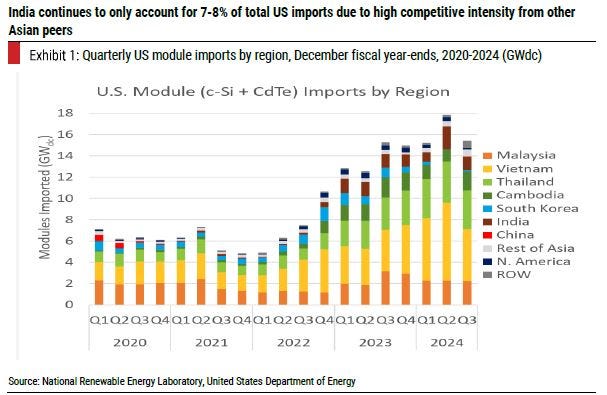

[10] Over the past five years, driven by multiple barriers to Chinese solar products, US module imports have been dominated by four countries, i.e., Malaysia, Vietnam, Thailand and Cambodia, which accounted for 80%+ of total US module imports. Over the past couple of years, driven by surging domestic solar module manufacturing capacity, India has become the fifth-largest exporter, accounting for 7-8% of imports.

Disclaimer : This newsletter is for information and educational purposes only. In this material, Amit Kumar Gupta (SEBI registered Research Analyst, INH100009327) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the RA may or may not have any future or existing position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them. Past performance on charts may or may not be sustained in the future and should not be used as a basis for comparison to infer any investment idea