AKG weekly charts - Issue #154

This newsletter is a weekly selection of 10 charts hand-picked across the internet and research reports which pertains to our investment strategy and bring an updated insight and perspective

My interview on Investing and Special situations with Upsurge [LINK]

My interview on the Investing Journey with Jagran Business [LINK]

Summary of financial markets in last week here.

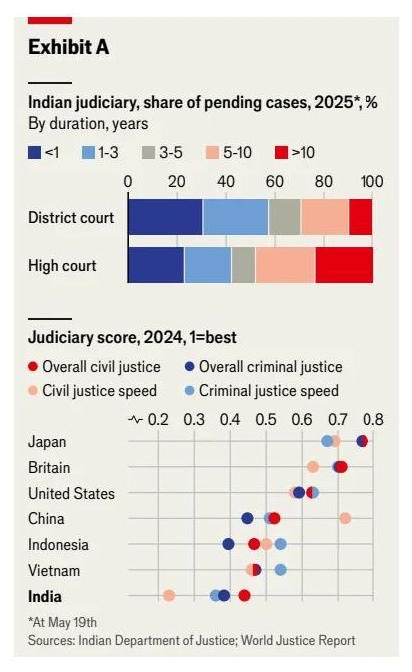

[1] India handles millions of judicial cases yearly and sheer volume is insane compared to judicial infrastructure! Layer it with culture of appeal pe appeal !

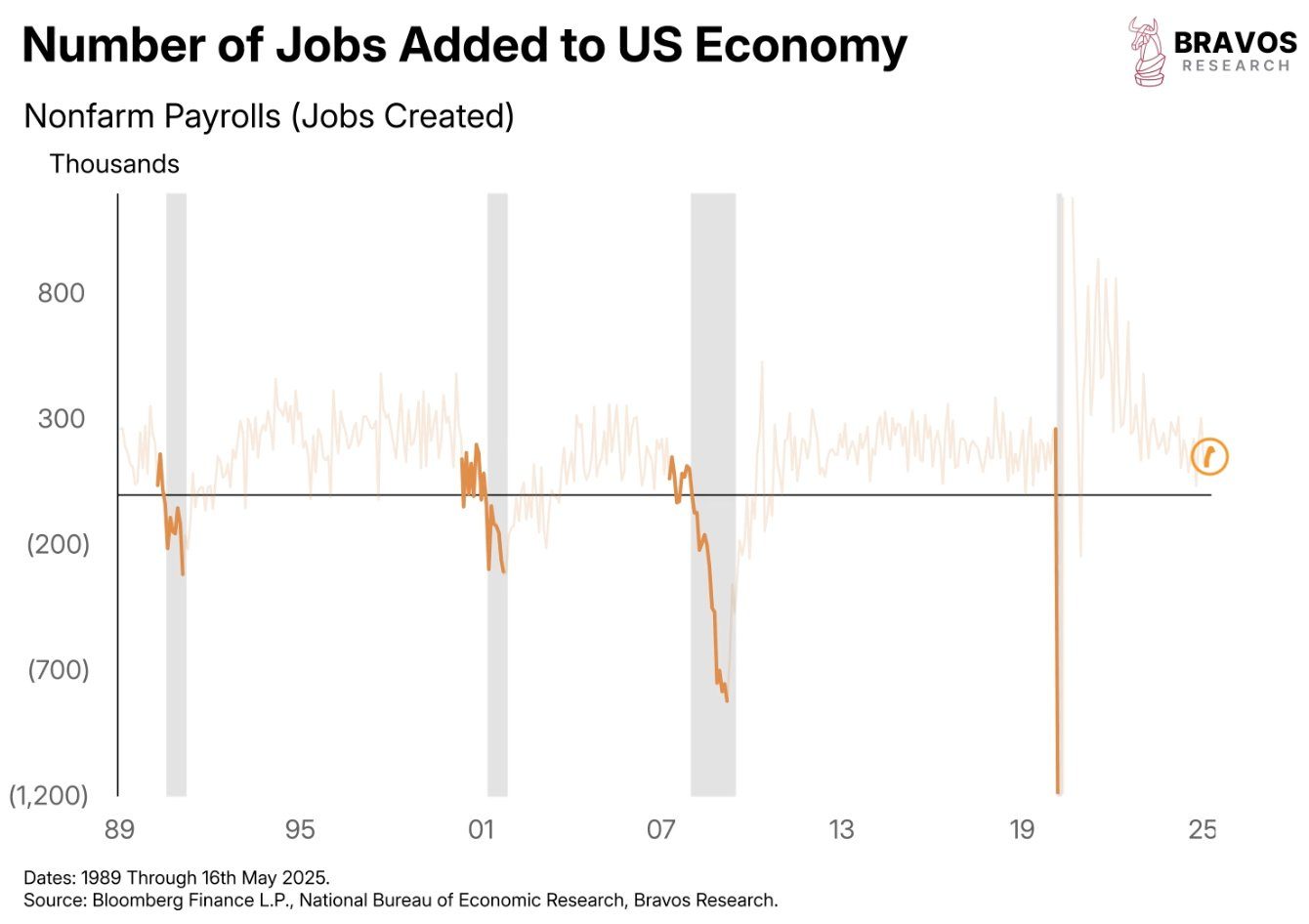

[2] This has happened in every past recession since 1989 in US. Job growth fell under 100,000, eventually turning negative. Today, that’s NOT the case The labor market added 167,000 jobs in April and has consistently stayed above 100,000, despite trade tensions and poor sentiment.

[3] China dominates nearly all segments of manufacturing exports. However, it is interesting to see how Vietnam and the UAE have gained a larger share than India.

Source: Bloomberg, WTO, Sundaram Asset Management

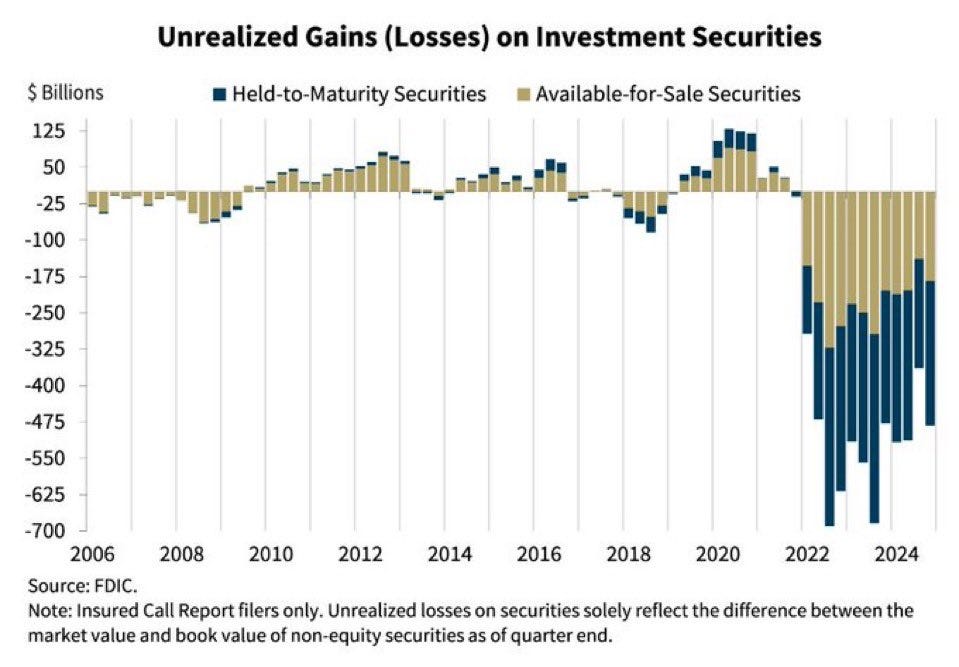

[4] U.S. Banks are currently facing $482 Billion in unrealized losses, an increase of 33% from the prior quarter. With rate cuts not coming, these losses are going to increase. Banks, particularly small banks, are in trouble!

[5] The Bloomberg Dollar Index fell to its lowest level since 2023 as new tariff threats from Trump and the risk of a widening fiscal deficit dragged on the currency’s appeal!

[6] U.S. credit default swaps are priced just as expensively as Greece's credit default swaps are. All izz well!

[7] Aviation Industry - Private Jet is booming. Stock invesment options limited in Listed Indian markets!

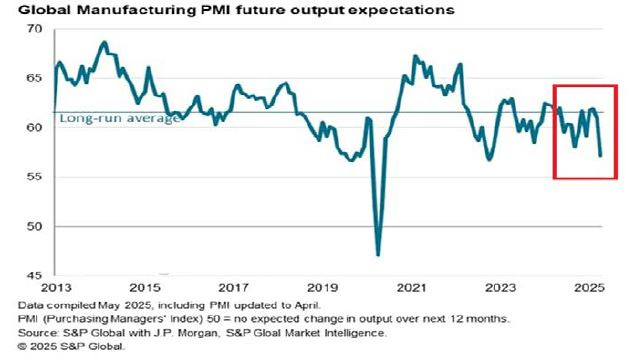

[8] Global mfg struggling under the weight of Tariff tantrums and slowing growth across the globe. India need to provide itself as a suitable alternative to China!

[9] MSCI china is looking for a break out during tariff wars!

[10] Japanese yields were all over the news last week and rightly so as it touches multi-year highs of 3.5%. BOJ actions will be keenly awaited in next month meeting!

Connect on various social media platforms here

Apr’25 review of our equity research strategy- Emerging leaders, Special Situation & Wealth Compounders. [Visit www.fintrekkcapital.com for subscription details]

Subscribe (free) to #AKGweekendreadings here [Newletter released every Friday]

Disclaimer : This newsletter is for information and educational purposes only. In this material, Amit Kumar Gupta (SEBI registered Research Analyst, INH100009327) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the RA may or may not have any future or existing position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them. Past performance on charts may or may not be sustained in the future and should not be used as a basis for comparison to infer any investment idea