AKG weekly charts - Issue #160

This newsletter is a weekly selection of 10 charts hand-picked across the internet and research reports which pertains to our investment strategy and bring an updated insight and perspective

Sept’25 review of FC equity research strategies- Emerging leaders, Special Situation & Wealth Compounders. [Visit www.fintrekkcapital.com for subscription details]

Connect on various social media platforms here

Subscribe (free) to #AKGweekendreadings here [Newletter released every Friday]

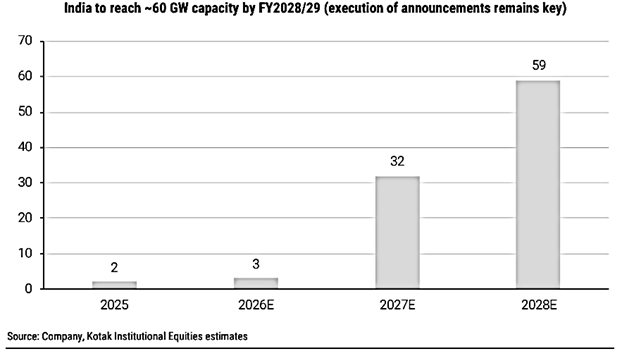

[1] Pathway of clean energy is clear, execution remains key. Stock valuations are a concern.

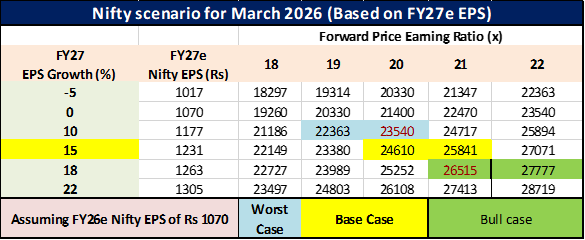

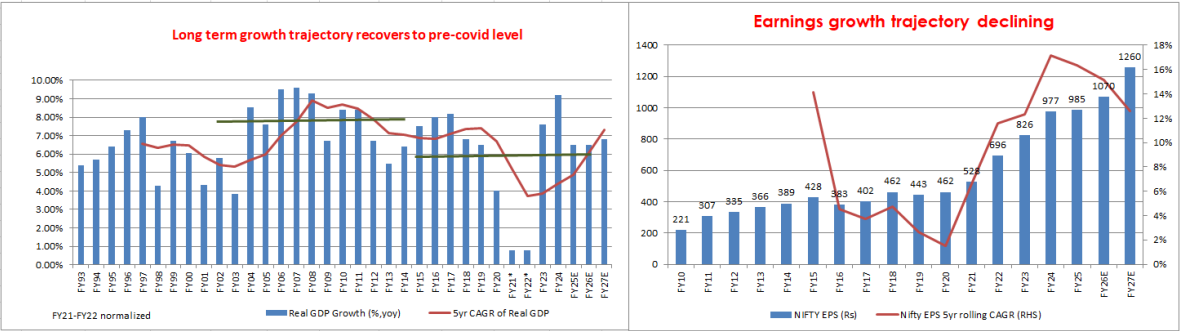

[2] H2FY26 is likely to bring in better earnings growth and hence, Nifty scenario for the next 12m can lead to newer ATHs.

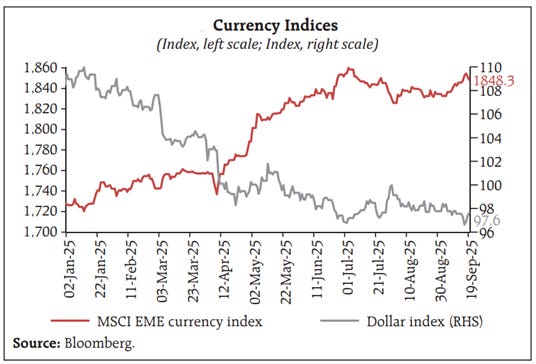

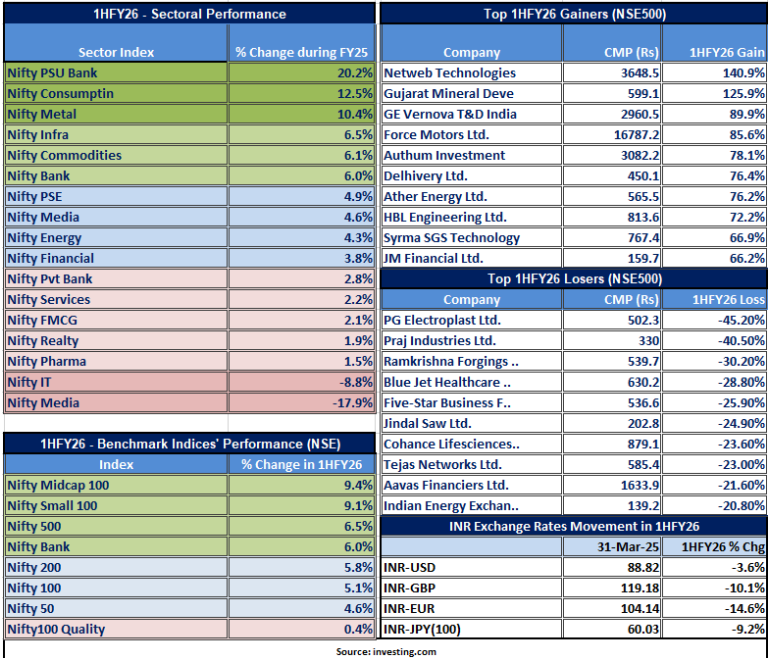

[3] Dollar index moving back to 102-104 range will help exporters in IT, Pharma and chemicals in near term.

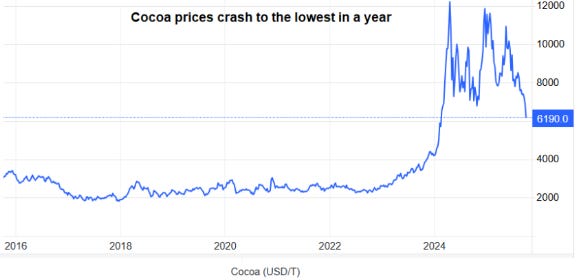

[4] Coffee prices are now down 50% from the recent highs on the back of softer industrial demand as manufacturers grapple with higher costs and tighter margins. Despite the recent downtrend, J.P. Morgan Global Research expects cocoa prices to remain structurally higher for longer at $6,000/tonne. The chocolate industry could raise confectionery prices as a result, with an adverse impact on sales volumes.

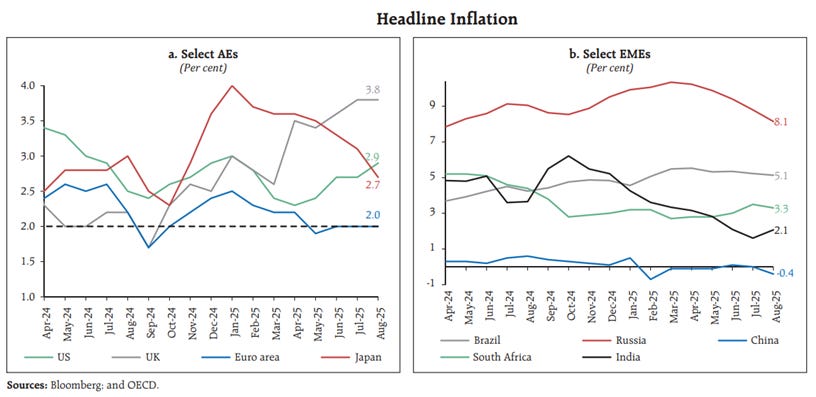

[5] India is controlling inflation very well at this point despite tariff shocks and supply chains readjustments.

[6] The benchmark Nifty50 gained 4.6% during 1HFY26; while the Midcap (+9.4%) and Small Cap (+9.1%) did much better. Consequently, overall market breadth was positive. Most of the market gains came in 1QFY26, prior to US penal tariffs coming into effect from July 2025. However, four out of six months yielded positive results.

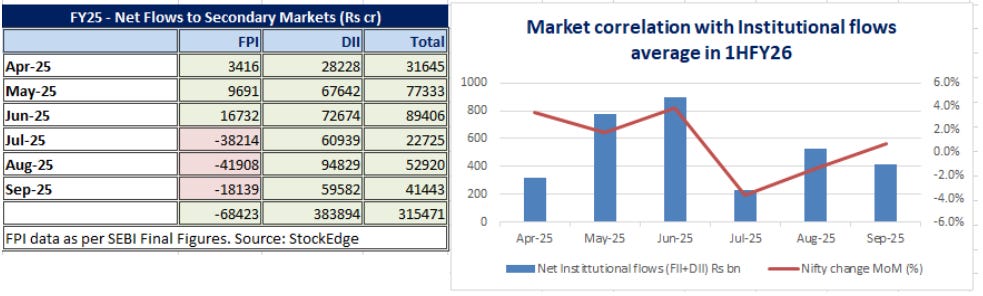

[7] Institutional flows to the secondary equity markets were positive for all six months. 1HFY26 witnessed a total flow of ~INR3154bn, despite net FPI outflow of ~Rs684bn. The correlation of institutional flows with Nifty returns was average (~56%)

[8] Corporate performance in 1QFY26 has been slightly better than the modest estimates, but signs of long-term earning trajectory slowing down are conspicuous.

[9] Precious metals best asset class in H1CY2025

[10] Semiconductor Stocks hit most overbought level in 8 years

Disclaimer : This newsletter is for information purposes only. In this material, Amit Kumar Gupta (SEBI registered Research Analyst, INH100009327) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the RA may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them. Past performance may or may not be sustained in the future and should not be used as a basis for comparison to infer any investment ideas.