AKG weekly charts - Issue #161

This newsletter is a weekly selection of 10 charts hand-picked across the internet and research reports which pertains to our investment strategy and bring an updated insight and perspective

Review of H1FY26 in Indian markets here

Sept’25 review of FC equity research strategies- Emerging leaders, Special Situation & Wealth Compounders. [Visit www.fintrekkcapital.com for subscription details]

Connect on various social media platforms here

Subscribe (free) to #AKGweekendreadings here [Newletter released every Friday]

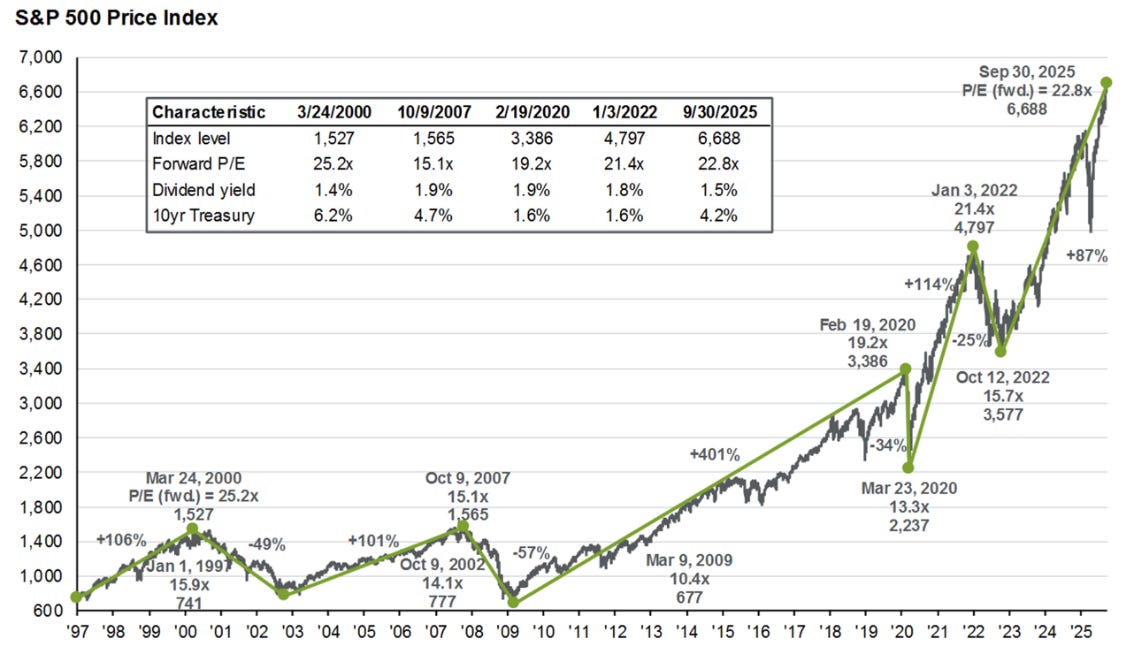

[1] S&P 500 index at inflection points…

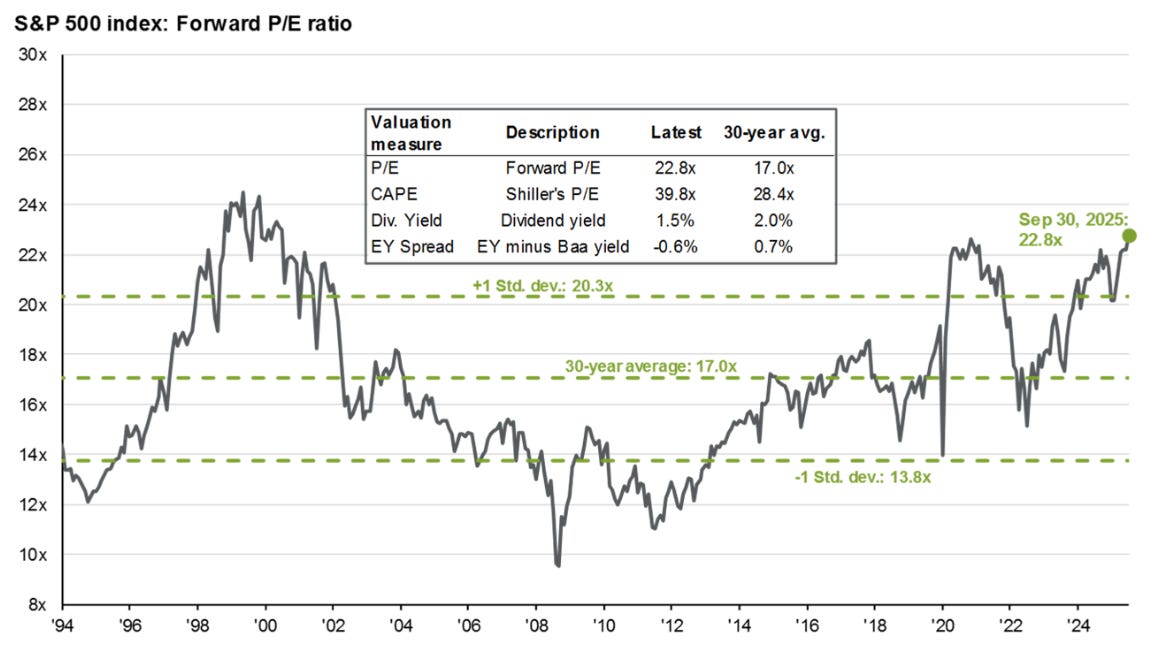

[2] S&P 500 valuation measures…

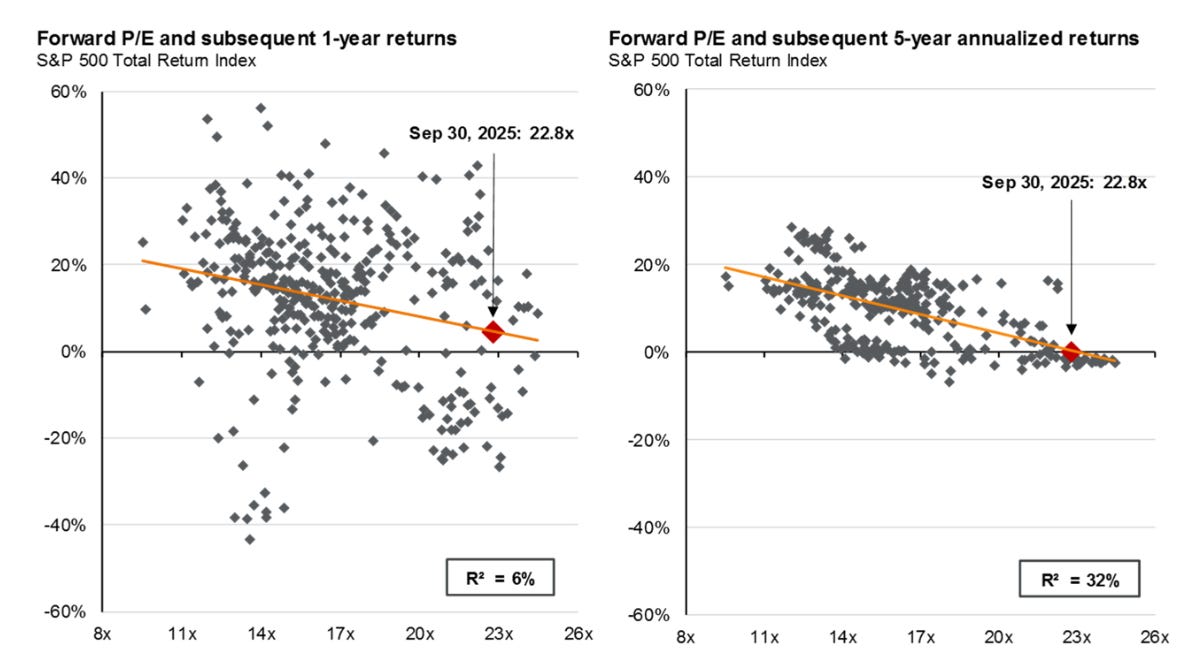

[3] P/E ratios and equity returns…

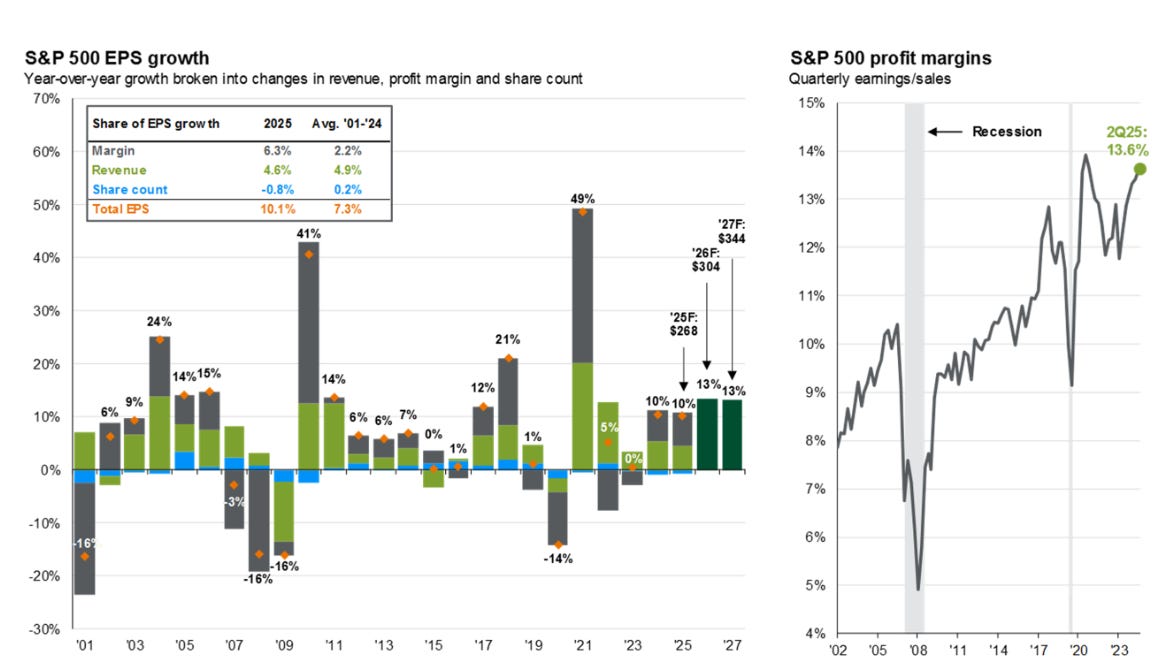

[4] Sources of earnings growth and profit margins…

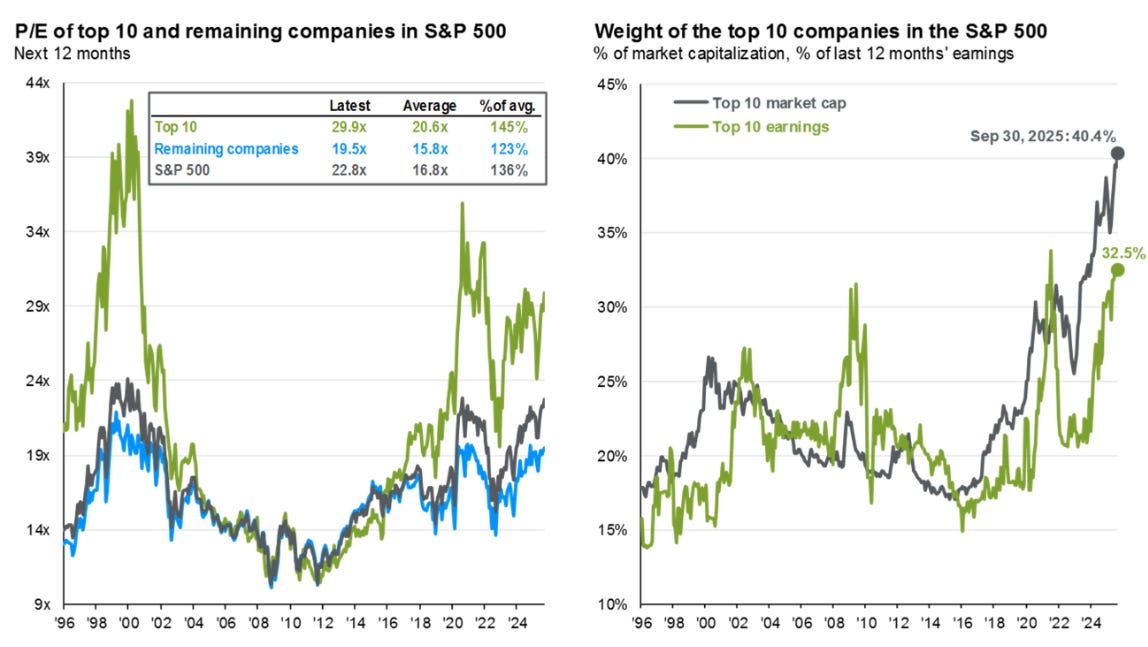

[5] S&P 500: Index concentration…

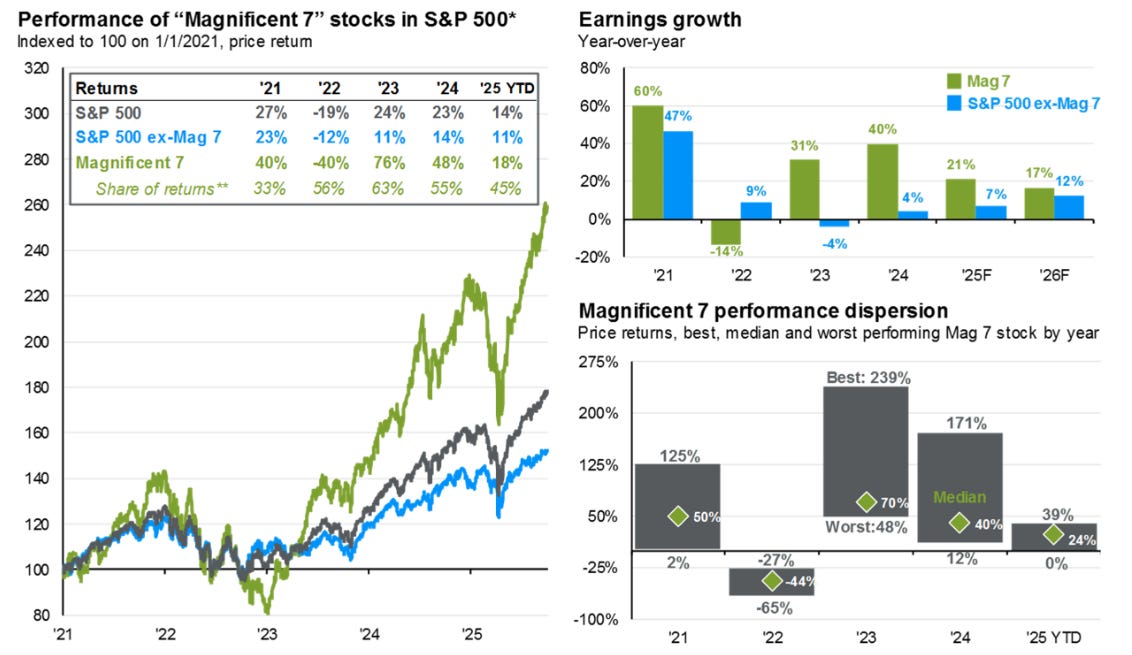

[6] Magnificent 7 performance and earnings dynamics…

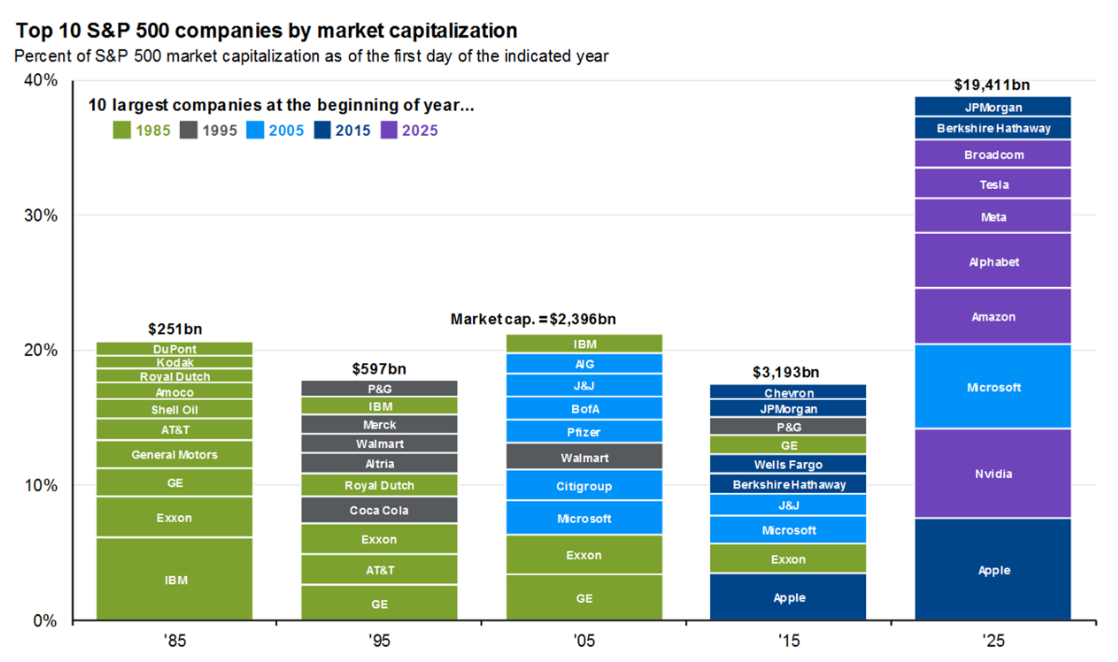

[7] Top 10 companies by decade..

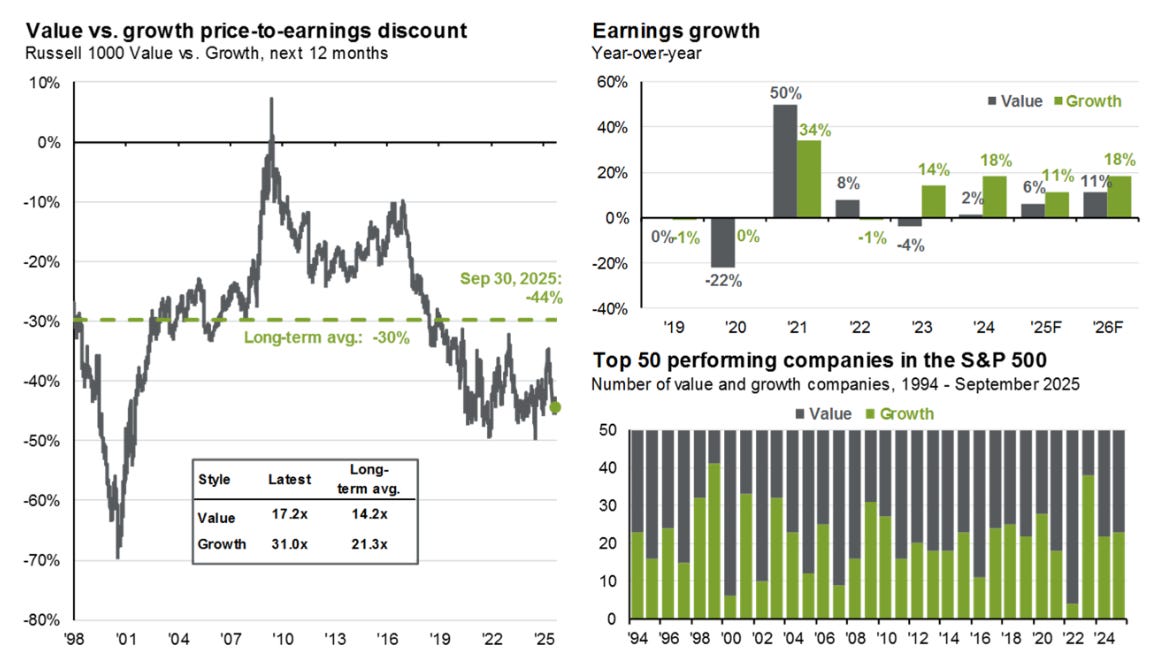

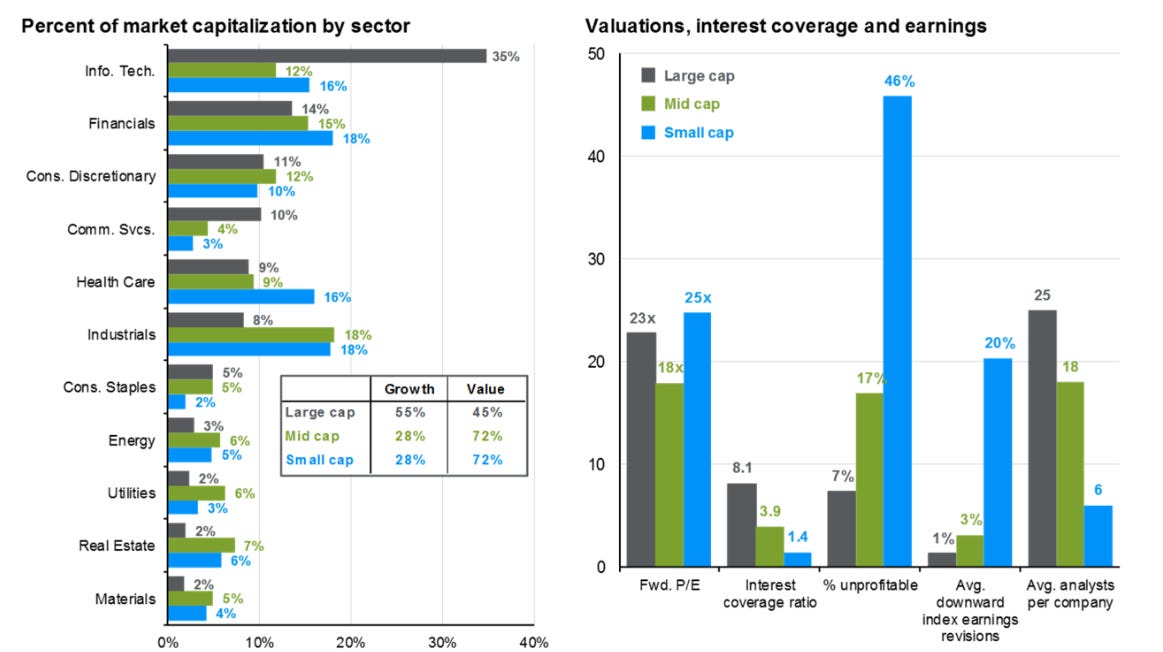

[8] Value vs. growth: Valuations, earnings and performance…

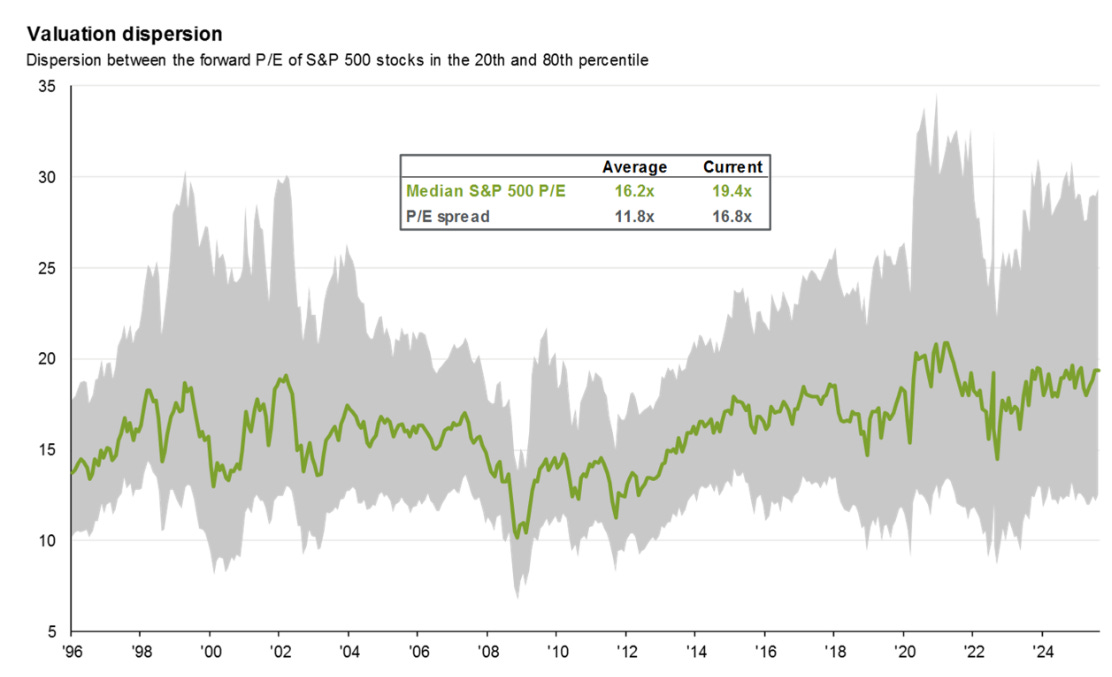

[9] Valuation dispersion…

[10] Small caps, mid caps and large caps…

Disclaimer : This newsletter is for information purposes only. In this material, Amit Kumar Gupta (SEBI registered Research Analyst, INH100009327) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the RA may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them. Past performance may or may not be sustained in the future and should not be used as a basis for comparison to infer any investment ideas.